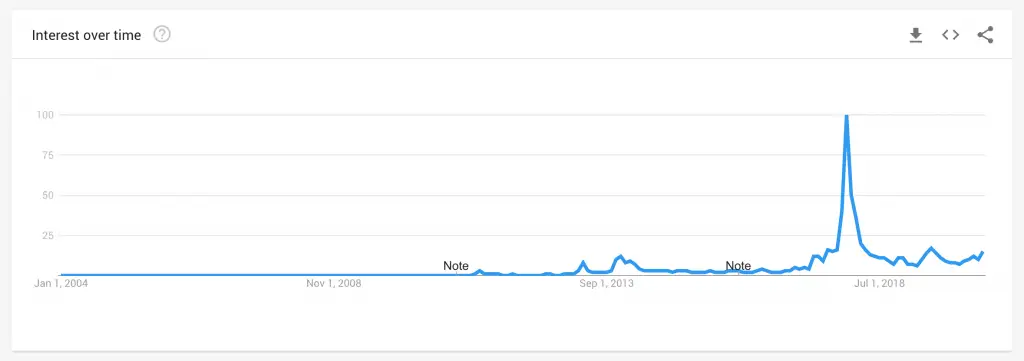

Buying Bitcoin has been a popular investing conversation for some years now, especially sine 2018.

Just take a look at the chart below.

Bitcoin investing peaked big time in 2017. The value of one coin went from about $1,000 in early 2017 to over $19,000 by the end of the year.

That is the most ridiculous growth I have ever seen in an investment. Lots of people became very wealthy, and sad to say but lots of people lost a ton of money investing at that point only to see it come crashing down a few months after.

See, the peak in the cart above went down dramatically, because the value of bitcoin also dropped from that $19,181 in December 2017 to around $3,497 in December 2018.

The whole year of 2017 it rallied, and the whole year of 2018 it kept tumbling down.

Investing in Bitcoin is important if you’ve covered all your savings goals and other general investment goals like investing for retirement (ROTH IRA) and have a regular investment fund.

Bitcoin investing, or investing in any cryptocurrency in general, could be a lucrative investment. Just make sure you take care of your safety net first before entering such a volatile investment arena.

Let’s dig in a bit more and talk about the 4 ways you can answer if investing in bitcoin is right for you.

1. Do I have a 3-month emergency fund saved?

No matter if you’re investing in Bitcoin or something safer like a CD, you want to make sure you have 3-months worth of absolute liquid cash available for any emergency needs.

The way you do this is to figure out how much your typical monthly expenses are, and save up several months worth of that.

If you usually need $4,000 every month to cover your financial debt (rent, car, bills, etc.), then you’d want to have $12,000 saved before considering Bitcoin.

This is only my tip, in a later point I’ll cover risk tolerance.

If you talk to someone who takes lots of risks, he or she would think you’re a fool to not invest a big chunk of money today.

Remember, the goal of this website is personal financial freedom, so we definitely want to get into risky stuff, just after we have our safety net covered.

Homework time, get out a piece of paper and write down all your typical monthly expenses. Let’s figure out how much money you might need on a monthly basis.

- Mortgage/rent

- Daycare

- Utilities

- Internet

- Phone bills

- Car payments

- Car insurance

- Life insurance

- Monthly groceries

- Gas

- Entertainment budget

- Clothing

- Haircuts

- Subscriptions (Netflix, Spotify, etc.)

On the left I listed out example monthly expenses that are a bit heavier in cost, and the ones on the right can be much more flexible.

Tip: Shortcut most of this research by looking at your credit card bills. It’ll have your most common expenses and average costs for things like food and entertainment.

2. What are my other investment goals?

I mentioned ROTH IRA as an example.

After you have your emergency fund built up, make sure you have other goals going before getting into bitcoin.

These could be..

- Putting money consistently into your ROTH IRA for some time now. You’ve made it a habit and can do more on a monthly basis.

- You’ve gotten other investment goals started too, like a health savings account, regular investment account, and so on.

- You also have money going to other life goals like regular monthly savings for a future house, future car, or anything else like that.

- These days, donating online is a great way to give to charities you believe in, and do it regularly. I have monthly donations set for Charity Water, Feeding America, and Doctors without Borders.

I look at my situation on a monthly basis. In point #1 I am looking to have money set aside every month for emergency fund saving, and in this point #2 I am looking to make sure that i’m not sacrificing my important investment goals in order to invest in crypto.

Again, others might not agree, but the mindset here is for those who want to never stress about money, and grow wealthy without extreme ups and downs.

3. Why bitcoin?

So you want to have a good answer here, because there are tons of other risky-ish investments that you could pursue.

Why not real estate? Why not forex?

The point here is that bitcoin is a fantastic investment opportunity, as long as you’ve spent some time learning up on it, and have a good reason as to why you want to put money into it.

It doesn’t have to be complicated. I myself watch YouTube videos on cryptocurrency regularly because I think its definitely the future. I’m no genius in the area, but I know how a ledger works, how bitcoin is mined, and how you can store your bitcoin as safely as possible.

Bonus: If you want to read the official paper from Bitcoins anonymous creator Satoshi Nakamoto, you can read it here.

I know enough about bitcoin to answer to myself why I should be putting money in to it.

And that’s the next part, I DO invest in bitcoin almost regularly, but only if I have money leftover every month after putting money into my emergency funds and retirement/investment goals.

After that, even if I have $50 that month or $150, I can safely put it into a riskier investment like bitcoin without much stress.

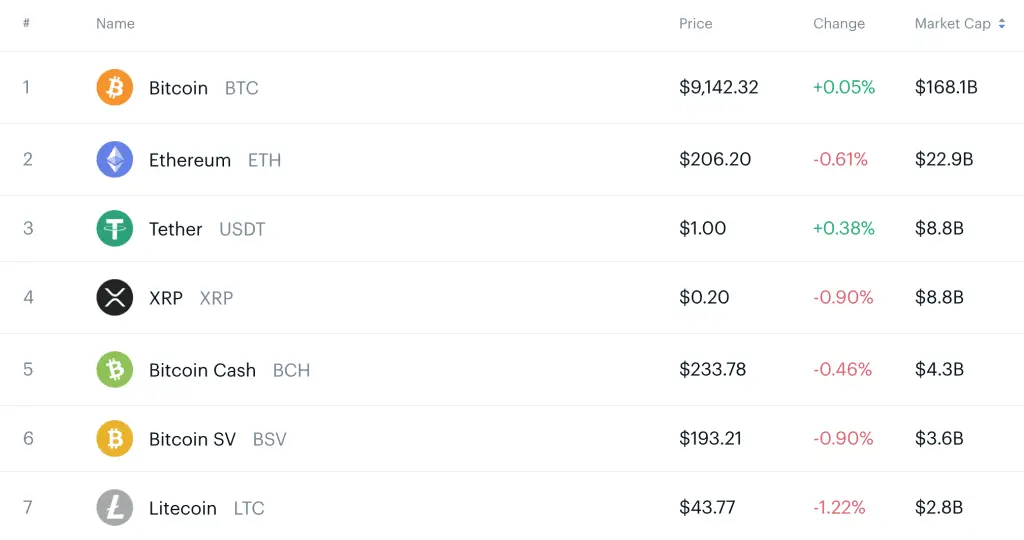

Also, there are tons of coins to invest in, that’s another thing you want to answer to yourself. Why bitcoin itself?

I myself have some Bitcoin and Etherium, and my answer to myself is that I’m just diversifying my money across 2 of the most popular coins.

All the other coins out there don’t compare to these 2, and none have as much money invested into a coin as bitcoin.

As of May 23rd, you can see below that based on coinbase.com, what are 7 of the top coins to invest in.

Spend some time understanding crypto currency in the first place (Wikipedia would be my first tip, then YouTube), and then figure out which coin you want to invest in.

Do you want to invest in the top-ranked coins because they look safer? Or do you want to do the research to find some potentially lower cost coins that could have great growth in the time to come?

Should I buy bitcoin NOW?

That leads to another question in this point. Should you be buying cryptocurrency now or wait for a better moment?

It’s May 2020 as of writing this post, so here are some key takeaways based on this time period.

- Bitcoin itself (and most other cryptocurrencies) have peaked and then mostly halved their value. From that standpoint it might be a good time to buy.

- Bitcoin is also set to halve in value soon. Not to get too technical but bitcoin halves every 210,000 blocks, so when miners get to that level (every few years) the currency will halve. It’s set to do that sometime this month of May. Another potential good reason to buy now.

From my standpoint the only negativity I see in buying Bitcoin is that it’s so freaking volatile. I stopped watching any of my investments on a daily basis 3-4 years ago.

So if you can buy coins, and then monitor them on a weekly or monthly basis, you might be able to reduce your stress from watching it go up and down all the time.

Can I get paid in Bitcoin instead?

Another option for this #3 option is to get paid in Bitcoin for work you do, instead of buying it.

You’re still essentially trading your time for money, just in Bitcoin. Those who did opt to get paid in Bitcoin back in 2009 or 2010, and kept it, became tremendously wealthier.

Check out the Jobs 4 Bitcoin Reddit board to see if you can find an opportunity to get paid in Bitcoin and grow your Bitcoin funds that way.

4. What’s my risk tolerance?

Say you’ve saved well for your emergency fund and also have #2 covered. Before you proceed to investing in crypto, can you answer what your risk tolerance is?

From 1-10, 10 being the highest, really look at your past experience and tell me what your risk tolerance is.

I’m a 4, I can’t stand risk, it stresses me the hell out. But I know I’m a 4 and not a 1, because if I have my bases covered with emergency fund and general investing, then I am happy to invest in riskier assets. It’s like my play money.

Here are some questions to answer to decide. If you answer no, give yourself a higher score like 7 or 10, and if you say yes give yourself something around 1-3.

- Do you have kids?

- Do you have a 6-month emergency fund?

- Do you have mortgage payments?

- Do you have large credit card debt?

- Do you make monthly payments on 2 or more cars?

Conclusion

Investing in Bitcoin is a great idea (or any other crypto like Etherium and Tether). Just make sure you have your other goals covered before moving to a riskier investment.

If you need help, I’ve made simplified posts on how to start your emergency fund and a ROTH IRA fund.

What did you think of my advice? Are you already investing in cryptocurrency? What questions do you have about it? I’d love to hear from you and help fill in the gaps.