Well, this one of those types of stories we don’t like to read or hear about. This is because it involves not just the loss of your fund, but in some cases, people have lost a lot more than just money when their investment goes wrong.

Wouldn’t you rather know? I would rather know if a Mutual Fund can go bankrupt, and if it does, what happens to my investment. So let’s get into it.

Yes, A Mutual Fund Can Go Bankrupt

Mutual funds are professionally managed equity holdings owned by their shareholders. Under normal circumstances, fund management can file bankruptcy under one of 3 chapters of the Bankruptcy Code. Any fund planning to liquidate and go out of business can file under Chapter 7 when it fulfills specific requirements.

Mutual fund management partnerships, limited liability companies, or businesses planning to reorganize and continue in business might file under Chapter 11. Mutual fund management Sole proprietorships planning to reorganize can file under Chapter 13.

In all three instances, only those resources owned by management are subject to creditor claims. These don’t include shares owned by the shareholders.

The Not So Bad News

Mutual fund liquidations, also known as full closures, are never pleasant news. Liquidation involves selling most of a fund’s assets and distributing the proceeds to the fund shareholders. Simply put, it means as a shareholder, you must sell at a time, not particularly favorable. At worst, it signifies shareholders suffer a loss and pay capital gains taxes too.

S&P, in a 2016 report about the operation of funds in comparison to their index benchmarks, noticed that almost a quarter of U.S. and global stock funds were merged or liquidated from the then-past five decades.

Most lifeless funds have been merged into a different fund class. This path is easier for investors since their money is instantly invested in a comparable and more effective fund.

Let’s review the different types of bankruptcy filings and the implication for all the parties involved, mostly how it affects regular investors.

Chapter 7 Filings

Mutual fund management files for bankruptcy under Chapter 7 of the U.S. Bankruptcy Court, which appoints a trustee. The fund management files a listing of debts and, generally, a listing of resources with the trustee. The trustee liquidates the assets and pays the creditors.

These payments are made in a particular order. Secured creditors are paid first, followed by unsecured lenders. Fund management’s corporate shareholders generally get paid last.

It’s important to note that fund management shareholders are different from fund investors like you and me, holding inventory stocks managed by the mutual fund.

Chapter 11 or 13 Filings

Filings under Chapter 11 or 13 are a lot more complicated than Chapter 7 filings. Under this type of filing, fund management has to file a listing of debts and assets and a restructuring plan. Typically, the trustee will create a creditors’ committee with restricted approval power within the reorganization plan.

The trustee will even approve filing deadlines and oversee the procedure, such as distributions to creditors. On occasion, it may take a long time to get a fund to complete the process and be discharged from bankruptcy.

When a Fund Cannot File for Bankruptcy

Filling for bankruptcy is not always as straightforward as it sounds. A lot goes in before the court approves or denies the filing.

Under certain conditions, a mutual fund direction can’t file for bankruptcy. Filings under Chapter 7 are subject to means tests of different types. Suppose the bankruptcy court considers that fund asset or income encourage tilts towards reorganization plan with partial or complete repayment of their debt. In that case, it might refuse to permit a Chapter 7 filing. The management might need to file under Chapter 11 or 13 rather than

For instance, if the court decides that fund management has committed fraud by submitting false asset and liabilities lists or revenue statements, it might disallow the bankruptcy. If this happens, the management of the fund will be entirely accountable for the debts.

When The Excitement Ends

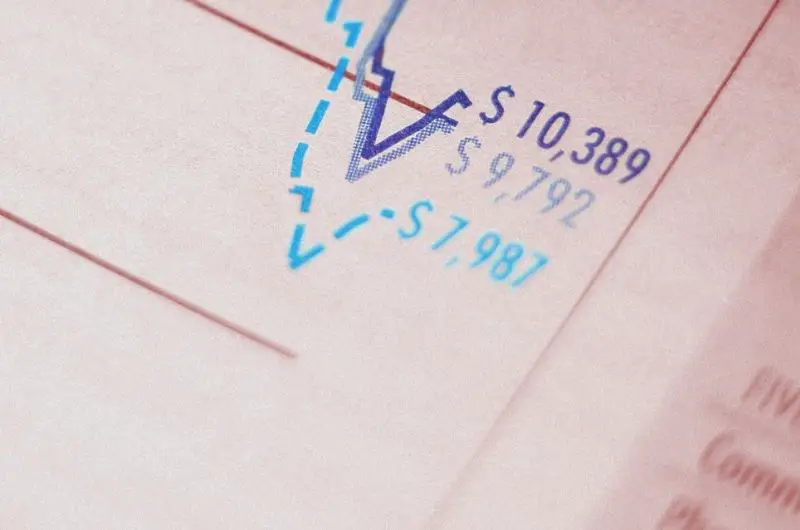

Yet, liquidations do happen, usually after a fund has fallen in value. This compels investors that purchased when the fund was more costly to sell at a loss. It gets worse if the fund has embedded capital gains, which may directly affect investors holding the fund in a taxable account. This is when a fund does not sell a stock that has increased in value since it was bought.

For investors, this means that even though the fund might have bought the stock before some investors purchased it, the tax obligation for all those profits isn’t passed on to investors before selling the stock. The gains are realized and paid to current shareholders’ accounts. This happens due to the “mutual” ownership feature of mutual funds.

So, once the fund is liquidated, the investor sells the fund for less than the cost and pays tax on capital gains, which they didn’t have to profit from. This may be especially detrimental to investors holding the fund from taxable accounts since the taxes can’t be deferred.

Reasons For Mutual Fund Liquidation

Mutual funds are liquidated for a variety of reasons, with bad performance standing among the key reasons. Inconsistent and poor performances reduce asset flows, as investors decide not to buy into a fund that is not doing well. Also, it pulls down the mutual fund management company’s track record. In case the company has five funds, and four of these do well, closing the bad performer gives the company a track record based on four effectively managed funds.

The poor performance also leads to bad publicity, which may result in significant redemptions. As the asset for the fund falls, the expenses of running the fund grow. Funds run on economies of scale, with larger being better in the cost-savings perspective. As prices increase, it can become unprofitable for a fund to stay afloat.

If investors are losing money, the fund is very likely to remain open so long as the fund could be managed profitably. Still, if the fund management begins to feel the pressure, it’s best to discontinue. After all, fund companies are in business to make profits for themselves and the investor.

Indicators and Decision

Several hundred funds closed almost every year through the late 1990s and the early 2000s, either with investors’ assets transferred into a different fund or distributing the resources back to investors. Investors’ resources are kept separate from fund management assets under a custodian’s oversight, usually a bank.

Niche funds are especially vulnerable since they’re frequently invested in trends or concentrated on such a small portion of a business or economy. There’s a risk the concept won’t ever catch on with investors.

Evidence that a fund is a candidate for going under includes

- A significant drop in performance continued without recovery.

- A bad history over a long time is just another warning.

- Poor long-term operation is not attractive for investors.

- Heavy redemptions are only another potential indicator.

Is It Time To Jump Ship?

If you have got the impression your fund is going under, what do you need to do? There are various strategies for various funds. If you are invested in an open-end mutual fund, and the end indicators are becoming evident, it is time to go for the exit as quickly as possible.

When investors want to sell a specific fund, the selling pressure tends to reduce its cost. Getting out earlier rather than later will help you to get a better price for your stocks and salvage as much of your investment as you can.

If your investment is in a closed-end fund, consider the underlying assets. If the fund is selling at a high, sell to make the most of your payout. In the event the fund is trading at a discount, then you might choose to hold since you’ll get paid on the assets’ full value once the fund liquidates them.

Conclusion

Mutual fund closures aren’t uncommon events. They occur all of the time as a portion of their fund sector’s natural business cycle. You can minimize your vulnerability to such events by investing in funds with long track records of success and carefully tracking your exposure to niche products.

When a closure happens, it is not the end of the planet. Take proper actions, learn from your expertise, and redeploy your assets to keep your long-term investment targets on track.

Reach out via the comment section. Let’s share opinions and views.