When you buy a fractional share, you can get a partial piece of a stock, allowing you to get invested in a company you like at a price you can afford. Instead of buying 1 share of Amazon at $3,000, you could buy in with the $200 you have and get 0.15 shares.

At a time where Amazon is valued at over $3,000 per share, and Tesla is close to $1,500 per share, how can you get a piece of the action?

Partial stocks, also known as fractional shares, is a new concept where you can get invested in growing companies that no longer have reasonable entry prices.

Companies like Ford and Sprint have almost always had extremely reasonable entry prices so that everyone can get them.

This is not the case for brands like Chipotle or Autozone. Great brands that you shop at and want to invest in are no longer an option for many. At the time of writing this, Autozone is just over $1,150 per share.

If you’re a car fanatic and wanted to invest in this company because you frequently shopped there and love the brand, it might be hard to save up to get a few shares.

Do you remember Berkshire Hathaway? It’s probably the most famous example ever in the stock market of a stock that is insanely out of reach for almost all investors.

When you look at BRK.A, the stock traded at $262.00 on March 3, 1980. Guess what it’s trading at today?

On December 2, 2019, it was trading at $339,178. Insane returns in that time period. This stock is clearly out of reach for almost everyone.

Now I know there’s a stock BRK.B which is the more affordable alternative, trading at around $194 in July 2020. I just wanted to make an example of stocks that go from good to blockbusters and go outside our reach.

Partial stocks to the rescue

With partial stocks, you’re now able to buy stocks at fractions of 1 actual stock.

From my previous Autozone example, let’s say you only want to put $200 per month towards this stock. Instead of waiting a few months until you have enough money for one share, you can buy fractional pieces of the stock every month and ride the wave of growth.

Mutual funds work similar to buying partial stocks

Buying fractional shares of stocks isn’t new at all. The concept of buying individual stocks at partial is fairly new, but the idea is quite similar when you buy a mutual fund.

With a mutual fund, if you go out and buy one for your Roth IRA, you’re going to invest in a fund where you’d get partial shares of all the companies involved in it.

For the sake of clarity, you most likely won’t see how much partial stock you have of all the companies in a fund. You’ll just see how many shares of the fund you own and what that value equates to.

If you take one closer look, heading to the “composition” area, you can see how many different stock holdings one fund has.

Where to buy partial stocks

At the moment, some of the popular brokerages to buy fractional shares of stocks include:

My Pick: Charles Schwab

I might be wrong on this, but from my research, I saw that Charles Schwab was the pioneer in fractional shares, introducing it to their customer base as an investment option back in October 2019.

When you have $0 commissions and can buy fractional shares, there’s really no excuse for anyone to start securing their future by investing and continuing to invest in great companies.

My Alternative Pick: Betterment

I’ve had an account on Betterment for a few years now, ever since they came out as a Robo-trading company.

Robo-trading is when you invest money and let their Robo-algorithm decide what stocks/funds to buy based on your risk tolerance and other goals.

The caveat here, and why this is my alternative pick, is that you’re not essentially buying individual fractional shares yourself at Betterment.

It’s more of a mutual fund type format, where you can put in $100 towards a goal, and then Betterment buys the fractional shares on your behalf, based on your goals.

Quoted directly from them, they said…

“You can’t go to the market and buy or sell fractional shares. However, a Betterment customer’s trades and resulting positions can be fractional—down to 1/1,000,000th of a share—putting every dollar to work while allowing every investing goal to be perfectly diversified”

Betterment

Robinhood

A very popular brokerage platform for the younger crowd, you can get a Robinhood account up within minutes and buy partial stocks.

I just don’t like the perception of Robinhood and don’t hold an account myself here. But that doesn’t mean it’s not a good consideration to get fractional shares from, do your own review to see if it works for you.

Can I buy fractional shares of any stock in the market?

I’ve mostly gone with Charles Schwab when I wanted fractional shares, and they’ve noted that you can buy any stock that’s in the S&P500.

That’s 500 of the most popular and strongest stocks in the market, but you’re limited to this set. You can’t buy penny stocks or any other stocks outside that S&P500 limit at the moment.

Regardless, that means I could buy quite expensive stocks like Amazon or Tesla for $5 increments, pretty awesome!

If you go with my alternative pick Betterment, you can get fractional shares of almost any company in the stock market. However, you’re not the one picking it. You’d set your investment goal and let their Robo-advisor take care of what stock should be bought at fractions.

Should I buy fractional shares or the whole thing?

When you’re thinking about moving forward with fractional shares, I’m sure you think of any limitations or problems that might come up with buying a fraction of a stock instead of 1 stock at a time.

During my research, I found no issues or limitations when buying fractional shares compared to an individual stock.

You’ll have a fraction of rights compared to when you have 1 individual stock regarding voting rights.

When it comes to dividends, that too will just be fractionalized based on how much you buy, and you get a split of what the dividend distribution would be.

How to sell fractional shares

So this is a challenging part of buying fractional shares. In a normal marketplace, people buy and sell lots of stocks or individual stocks, not fractions of them. There isn’t a marketplace for that.

To answer this briefly, the only way to sell fractional shares is via the same place you bought them from since there is a marketplace there to facilitate them.

You can’t buy fractional shares on Charles Schwab and then roll over your account to another brokerage like TD Ameritrade and be able to sell your shares. At the moment, TD is still considering setting up fractional shares as an investment option for their members.

Fractional shares and dividend investing

I wanted to add this here for those who are young and/or starting off investing as beginners.

It’s great to invest and get huge gains from stock upswings, but I wanted to also share my personal insight into this.

I’m in my 30s right now, young and able to make money for some time. I can take part of my monthly income and invest it to build my nest egg.

But how will I want things to be when I’m retired? How would I reflect on my investing journey when I’m in my 50s?

I’ve been thinking about this lately, and I keep going back to my original goal of having a solid dividend-income portfolio.

A dividend-income portfolio is basically where you buy stocks that specifically pay out dividends.

We won’t go into the pros/cons of dividend payment. Still, the single benefit for me was that I’d get reasonably predictable income monthly or quarterly (depending on the dividend payout for the company that I buy stocks in).

Now, reflecting on this, I figured that by the time I’m in my 50s, I would have wanted to be well on my way towards a sizeable dividend income portfolio so that it could replace my ordinary salary income once I retire.

Say I make $100k a year. I’d want to invest to the point where the dividends from those stocks that I own would pay out roughly that amount a year.

If I wanted a $100k dividend payout, my portfolio would be roughly $2,000,000. That sounds crazy, but I just put it out there as my plans and work towards them.

My goal is to retire and not stop having income coming in, so a dividend income portfolio is crucial.

Now, going back to fractional shares. Say you’re young or starting at a fairly young age. If you’re starting to invest and can only do so with a little bit of your monthly income at the moment, you could buy fractional shares specifically with stocks that pay out handsome dividends.

Essentially, you’ll be starting your dividend income portfolio without having to buy expensive shares. You can do it at the price you can afford at the moment!

How awesome!

Check out some of the best dividend stocks in the S&P500:

| Stock | Sector | Dividend Payout |

| Navient Corp (NAVI) | Finance | 4.8% |

| AT&T (T) | Telecom | 5.1% |

| Welltower (HCN) | Real Estate | 5.5% |

| HCP (HCP) | Real Estate | 5.5% |

| Scana Corp (SCG) | Utilities | 5.7% |

| Oneok (OKE) | Energy | 5.7% |

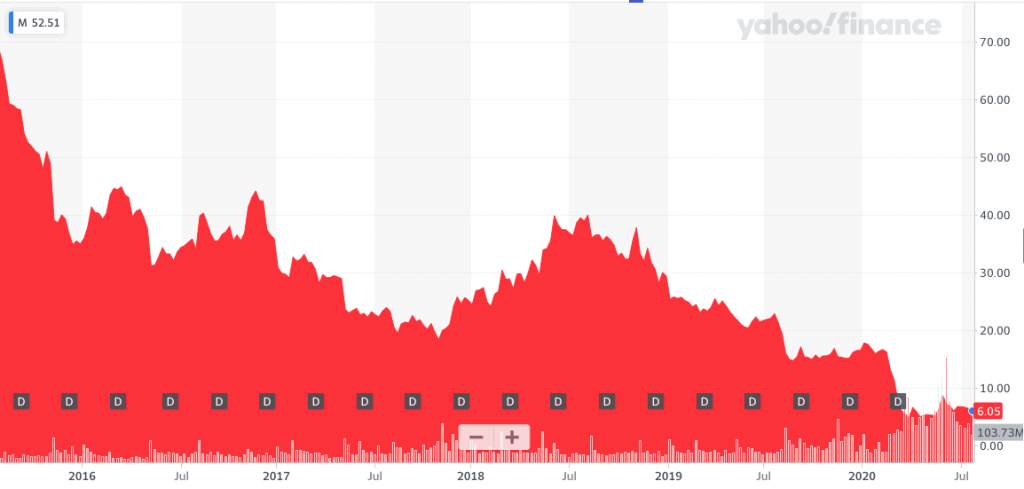

| Macy’s (M) | Retail | 5.9% |

| Seagate Tech. (STX) | Tech | 5.9% |

| Kimco Realty (KIM) | Real Estate | 6% |

| Iron Mountain (IRM) | Real Estate | 6% |

Note that real estate and utilities are usually the best for dividend payout.

Also, note that even though you have the goal of dividend investing and getting frequent payments, you also want to do your due diligence with the company.

While Macy’s does pay out dividends pretty well, the stock itself has been in trouble for years now.

While a 5.9% dividend return per share is awesome, that’s 5.9% of a stock price that’s gradually going down.

You can see above that Macy’s stock has been on a downward trend since at least 2016, where the price at the time was close to $60.

Right now, it’s closer to $6.

While this company might be heavily affected by online e-commerce (from companies like Amazon and Shopify), other companies will have their ups and downs but head in an overall upward trend.

Things happen, find company’s you buy from and love, learn everything you can about them, and see if they pay out good dividends.

Then start building your retirement income plans by starting with fractional shares. Let’s go!

Conclusion

Buying fractional shares brings about exciting times for new investors. A July 2020 article from the Washington Post shared how fractional shares investing sparked a stock market stampede because it allowed almost everyone with some amount of cash to start investing. I think it’s a great thing.

Companies used to stock split often (every few years) to keep their growing brand at a reasonable cost per share.

I haven’t seen that happen too much lately, so this partial stock opportunity is excellent for new and seasoned investors who want to get in on their terms.