Setting up high expectations for a partner almost always leads to disappointment. And when I say partner, I mean the person who will be by your side and share the same long-term goals as you for years to come.

Should you settle with a boyfriend with minimal to no personal finance knowledge? And what about a boyfriend who is broke or deep in debt?

I had a long-term relationship with a boyfriend who earned triple my pay and was always, and I mean always broke days after he got paid.

At the time, my finance knowledge was not as profound, and I didn’t pay much attention. At least at the beginning. When I started budgeting, saving, thinking about the future, mentioning retirement funds, and initiating big purchases, he was puzzled. The words saving, money management, and investing were so foreign.

How do you work on your financial goals with a person who cannot manage their money? How to approach a relationship with a person who doesn’t have an emergency fund at 30?

Depending on the reason your boyfriend is broke, there are a couple of things you can do; teach him the basics of personal finance -budgeting, debt payoff, and savings; get him onboard your financial journey, and help him get a better-paying job or side gig.

Relationships and finances are not always rainbows and butterflies; both require attention and nurturing to thrive.

What Is A Broke Man?

Love is one of the world’s best feelings, but we realize it’s not enough for a relationship to work out as we grow up.

We’re not expected to have it all figured out in college, work a six-figure job, pay off student loans, and save for a house downpayment. But some men tend to linger in this stage longer than necessary.

A broke person is either someone who doesn’t work, has a low-paying job, or is terrible with money. A broke man can’t cover his own needs with the amount he earns and often drowns in debt. He can hardly share rent, bills, or fancy date night expenses.

The worst side of a broke man is a lack of purpose and motivation. He doesn’t appreciate himself enough and is stuck in a loop of a low-paying job and unreasonably spending his money.

First Financial Warning Signs

A saying that my grandma used to tell often stuck with me throughout my whole dating life: ‘When poverty comes through the door, love leaves through the window.’ Here are a couple of financial warning signs to look for in the dating stage of your relationship.

Debt of all kinds

Student loans, credit cards, personal loan, car loan – you name it he’s got it. Rather than paying off, he makes minimum deposits – and even skips some months.

He’s out of work for most of the time

I have a friend who dated a guy who would work for a total of 3 months a year and complain for the remaining 9. Whether it was the schedule, the payment, or the management, there was always something that pushed him to quit the new job.

He lives over his means

You’re aware he earns $35,000 a year, but he wears branded clothes, is always out, and takes lavish vacations. This is all put on his numerous credit cards, of course.

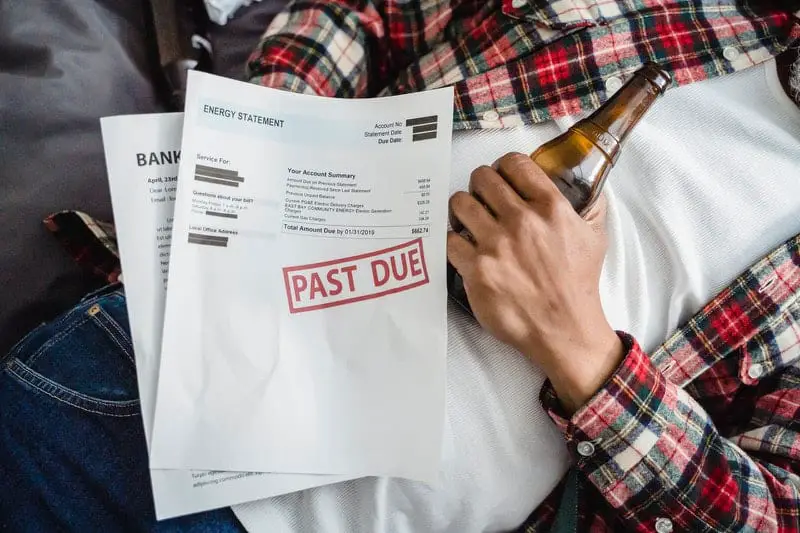

A pile of over-due bills on the coffee table

If you find a pile of unpaid bills on the coffee table on your first visit to his place, there’s no reasonable excuse. When you question him, he stays tight-lipped or changes the subject.

You pay for every date out

You buy tickets to concerts, bring groceries to cook together, pay for dinners, movies and even cabs. He never offers or reaches for the bill.

Living with numerous roommates, or his parents

If his place looks like a frat house and he’s over 25 years old, I have bad news. Same goes if he went back home after college, where his parents cover his bills, car insurance and food.

He’s baffled at the mention of budget, investments, retirement savings

You mention you’ve reached your Roth IRA goal for the year you plan on investing in an ETF fund. He looks into the distance having no idea what you’re talking about.

After years of work he has no assets

He’s been into the corporate world right off college, but he has exactly $0 to his name. Each dollar went out with the speed of light.

How To Deal With A Broke Boyfriend

The days when a man was supposed to be the sole provider for his family are long gone. Women are highly educated, independent, have fabulous careers, and are capable of sustaining themselves. But carrying an unemployed, broke boyfriend on your shoulders is not fun.

Figuring out why your boyfriend is broke is the first step. Realizing if he is aware of the situation is the second step. There’s a massive difference in whether his financial situation is temporary or has been like that for years.

Some people lack personal finance knowledge when they go out of college and out in the real world; I was one of them. I learned so much, and I think everyone who wants can learn to be better with their money.

Inspect the situation; if your boyfriend is willing to work on his bad money habits, he will work more to pay off debt and live a more humble life for a period to make up for years of neglecting his finances.

I spent 4 years of my life with a boyfriend who I thought was very successful. He had a high-paying job, a promising career, a car he bought in cash, and we were going on fancy dinner dates.

Two years deep, I realized he was broke. He was “temporarily” living with his parents for 8 years, and they bought his car.

He was out of money days after getting paid and had $0 in savings. Best of all, he started an emergency fund but used the money to pay for speeding tickets and never put it back.

I initiated a 5-day trip to Amsterdam, for which we would share the expenses. He was baffled, used excuses how Amsterdam was too expensive, and he’s not in the mood for a Euro trip.

The second and final nail in that relationship’s coffin was when we mentioned moving in together. He didn’t want to pay rent and thought buying was a smarter decision. But here’s the trick – he never found “the perfect” apartment for us to buy.

I was saving 40% of my paycheck; he was spending 40% more than he earned. I decided to leave the relationship and pursue my financial goals alone.

When You Make More Than Your Boyfriend

“I make more than my boyfriend” is not a saying you get to hear often. Women make 17.7% less than men; for every dollar a man makes, a woman is paid 82.3 cents. Still, women nowadays have high-paying jobs and successful careers that some men can never obtain.

If you’re one of those women who have their life in order and pay special attention to all aspects of personal finance, ending up with a man who makes significantly less might be a problem.

Putting gender roles aside, it’s up to you what kind of life you’re comfortable living. If you’re capable of covering rent, bills, and paying for vacations for both of you, all while saving and investing, that’s great. But there can come a moment when you feel like you’re being used.

For a relationship to function properly, both partners need to be on the same financial page. Relationships are not a competition about who’s better and makes more money.

I brought this topic to my current boyfriend, who makes just $100 more than me. If he were to make half of what he makes, we wouldn’t have bought an apartment together or afford tropical vacations.

I’m not capable of paying for both and don’t find it reasonable. If one of us earned 50% less, our lives would be totally different. He doesn’t feel comfortable with a woman that earns significantly higher. Keeping up with a more luxurious lifestyle to him would be financially exhausting.

A broke man can turn his life around or drag you into his despair. You can help your broke boyfriend but not by covering his debt, bills and giving him cash.

You can help him improve his skills and resume, apply for better jobs, and teach him how to budget his earnings. But if he’s comfortable with his situation, he might drag you into his despair, and that’s a huge red flag.

Love Doesn’t Conquer Financial Instability

In a relationship, love, understanding, respect, compassion, and support are essential. If you don’t support the life choices of your broke boyfriend, it’s the right time to end the relationship. You can’t run away from his financial situation forever, and you can’t help him if he doesn’t cooperate.

A financially stable partner is vital to many life questions like housing, kids, and retirement. You can either have the freedom to discuss investments to better your future or deal with heaps of unpaid debt.

Realistically you need someone who aligns with your perspectives. If you’re financially stable, a hard worker, and make most of your money, you wouldn’t settle with a broke man.

Bottom Line

Dealing with a broke boyfriend can be an educational experience. When you’re deep into personal finance, some broke person’s actions can look like an absolute nightmare. You can learn to look for the signs early on and avoid people with a broke mentality.

It’s important to note that a person can be broke even if they’re working a high-paying job and live independently. The amount of debt behind the picture speaks volumes of their habits.

The conclusion is you either adapt to living with someone who’s totally incapable of managing their finances, teaching him your ways, or moving on.