Raising a family of four while maintaining an amortized home is something I thought I could never manage before hitting thirty, but with the help of these personal finance techniques, it became totally possible for me.

Create a budget and stick to it

every financial advice you will encounter anywhere will always include budgeting. There is a reason why a budget is critical in succeeding with personal finance. It simply works. Especially if you stick to it.

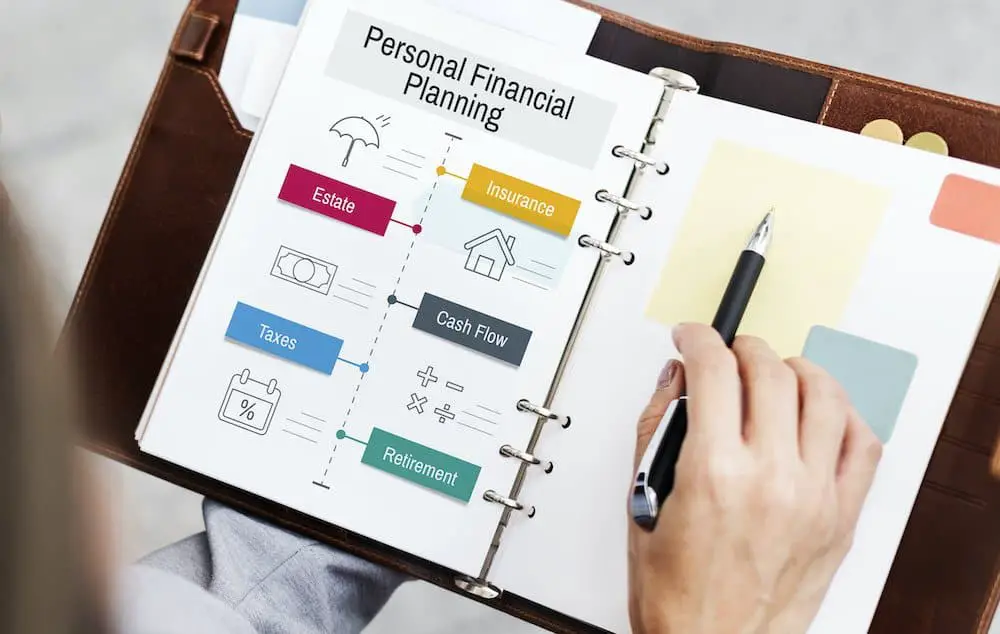

It does not have to be an elaborate list of every penny you earn and spend in a month. Find a method that you can sustain and that it works for you. It can be as straightforward and rudimentary as portioning your income into main compartments such as the one below:

You can further subdivide each main compartment to tailor to your personal financial situation. You can place salaries, business income, tax returns, and other incoming money into the income portion. Your utilities, groceries, shopping, and debt payments can go into the expenses portion.

Meanwhile, the money you put into your emergency fund, your savings account goes into savings. The same goes for your retirement, insurance, and college fund.

Save first before you spend

A common mistake made by people who are totally new to personal finance is saving leftovers after having spent. Usually, you end up becoming inconsistent with your savings, or not having any money left over to save after your spending spree.

Notable investor Warren Buffet popularized this method of managing your finances. He says, “do not save what is left after spending, but spend what is left after saving,” and it totally makes sense. If you follow this system, you get consistent savings every month, and you can watch your savings grow at a predictable rate to fit your financial goals.

How do you go about this method? Do you just set a fixed amount and commit to it paycheck after paycheck? How do you determine how much you can safely save so that it does not affect your needs and lifestyle in a negative way?

The first thing you need to do is to determine the pattern of your cash flow. How much do you earn in a month? Then calculate your average expenses including bills, credit payments, and other necessary expenditures. Whatever is left over from your calculations should be the amount you can commit to savings on the regular.

Usually, this amount is about 10-20%. If you live a fairly frugal lifestyle, or if you have a particularly large financial goal or want to reach it faster, you can adjust this percentage to be higher.

Minimize debt as much as possible

Being trapped in debt sucks. It eats up your finances and delays you from achieving your financial goals. Most of us wish we could just wake up one day and be completely debt-free.

However, some debts are just too large and seem impossible to conquer. You might be wondering, what are the secrets of those who are debt-free? If they do not live under a huge trust fund, it could only be sound personal financial management.

What to do with debt

So what do you do when faced with debt, especially large ones? Here are some of the best strategies when handling your debt:

- Pay more than the minimum. You might rejoice that your credit card offers a fairly small minimum payment requirement, but you’ll end up paying far longer and far more due to compounding interest. If you want to speed things up, you need to increase your regular dues.

- Pay off your most expensive debts first. This does not necessarily mean the biggest one you have, but rather the one with the highest interest. Paying these debts off first means that you are not paying any more than is necessary.

- Cut back on other expenses to allocate more to paying off debt. There are several ways you can cut down on expenses if you want to pay off your debts for good. Consider frugal living. Eat more of homemade food rather than take out, try to grow your own vegetables and spices instead of buying them constantly from the supermarket, walk or bike to work instead of driving, get rid of your car if you don’t really need it, live in a smaller house.

- Earn more. If you can’t get a job upgrade or a promotion, consider getting a side hustle or a home business that you can do in your spare time. If you have a special skill you can offer up for a fee such as photography, design, or writing, you can earn a bit of extra so that you can dedicate all of your extra earnings to pour into your debt. In this manner, you do not have to make adjustments to your lifestyle in trying to make more room for debt payment in your regular budget.

Plan for the foreseeable future

Everyone gets old and retires at some point. If you have children, you’ll send them to school at a certain age. If you want them to have a good start in life, you might want to send them to college in the future. And as unpleasant as it may sound, everyone dies.

There are certain life events that are just inevitable. People who come face to face with them unprepared feel shocked and overwhelmed by the financial obligation that such life events demand. They could have prevented all that stress and helplessness with a little bit of foresight.

A concrete analogy would be like a pregnancy. You are expecting a baby at the end of it, and having a baby entails a huge financial responsibility. That is why you spend a lot of time preparing ahead for it. When the baby comes, you will have had enough funds to care for a child and pay for the delivery.

The same principle applies to retirement and college funds. You have at least an estimated time when you will need a large sum to support your lifestyle and your child’s higher education. That is why it is important to save for it as early as possible, because if you start too late, you might not be able to save enough.

Plan for the unforeseeable future

Just as we can anticipate life’s inevitable events, it also cannot be avoided that it might throw in a couple of surprises. These unexpected occurrences can be financially devastating if you do not have any back up plan or safety funds to get you through.

I remember experiencing a flash flood as a kid in my parent’s house. The water flooded our entire first floor and swamped the furniture and some appliances. The most prominent memory I have of it was when our fridge floated.

I didn’t think much about it as a child. I only felt amused about our floating fridge. But as an adult, I can’t help but realize how financially devastating all that damage must have been if my parents weren’t prepared.

In life, there are several unforeseeable crises that we may or may not go through. They can potentially destroy finances, cause you to lose your comfortable lifestyle, and put your family’s future in jeopardy. The trick here is to prepare as much as possible for such instances.

It does not have to be an elaborate set of plans that are specific for each type of emergency. You can simply set up an emergency account wherein you can take out a sum in case of a financial problem.

Make life and health insurance a priority when setting up your emergency fund. Later on, once you feel settled and confident enough to step up your financial preparation, you can opt to insure your property and everything else.

Set up a “fun” budget

Personal finance without fun is not a good idea. It provokes negative feelings towards budgeting and can easily dampen your resolve towards getting your finances in order. Responsibly managing your money should be fun and motivating.

To inspire you to save and pay off debt, have an end goal in mind. It could be several big end goals like retiring early, constructing your own house, and starting or expanding a business. Along the way, litter your progress with some milestone “treats” to reward yourself as you reach a stage closer to your end goal.

For this, you can set up a specific portion of your savings as “fun money” which you can take out every time you hit a milestone. Your milestones can be as simple and straightforward as saving a specific target amount, being able to wipe out a debt, or consistently paying your retirement premiums on time for the whole year.

It is entirely up to you how you want to spend your fun money. Its entire existence is solely for the purpose of your gratification. If you love to travel, you can use it to go on a vacation.

If you love to shop, you can splurge on yourself. You can also use it to buy something which you have always wanted but was not essential enough to be included in your budget.

Conclusion

Personal finance should be a gratifying endeavor. Personally, I appreciate the feeling of security and preparedness that proper financial planning has given me and my family. It also feels nice to watch your savings grow and know that you can use it someday to give your family a brighter future.

You do not have to become outrageously rich to experience financial freedom. All you need is some planning with personal finance, a good amount of discipline, and lots of motivation.