Knowing how to successfully invest money is one of the most important aspects of personal finance and can dramatically impact an individual’s standard of living.

With benefits ranging from a more comfortable retirement to simply better peace of mind, investing is a massive responsibility that must be taken seriously. Once a person gains a basic understanding of important investing tactics and guidelines, they must then become familiar with the various taxation laws surrounding investing to develop and cultivate a successful investment portfolio.

The taxes levied on capital gains, the profits from investing, vary greatly in the United States and are impacted by both federal and state law.

Definition of Short-Term and Long-Term Capital Gains

Short-Term Capital Gains

Short-term capital gains are the profits gained from the sale of a capital asset that has been held for a year or less. Examples of capital assets include stocks, bonds, precious metals, and real estate.

Long-Term Capital Gains

Long-term capital gains are the profits gained from the sale of a capital asset that has been held for more than a year.

Federal Tax Rates for Capital Gains

Short-Term

Short-term capital gains are treated as additional income for the tax year and are usually taxed at the same tax bracket that an individual’s gross income falls under.

For example, if a single person had a gross income totaling $35,000 from a salary and $3000 from short-term capital gains, they would pay a federal tax of 12% on both the $35,000 of regular income earned for the tax year and the $3000 for short-term capital gains.

However, if they instead earned $38,000 from salary and had a total of $3000 in short-term capital gains for the year, the taxable income would be $41,000 and would put them in the 22% tax bracket.

However, they would still only pay the 12% rate on the $38,000 of regular income, only paying the 22% on the short-term capital gains. The significant increase in the federal tax rates between these brackets for short-term capital gains underscores the importance of being familiar with tax laws to generate the most amount of income possible.

In this example, if the individual would have simply waited for more than a year to cash in the capital investment, they would have had $38,000 in gross income taxed at a 12% tax rate, a total federal tax bill of $4560.

However, by cashing in their investments in the short-term, they lost an additional $660 from their short-term capital gains increasing their total federal tax bill for the year to $5220.

Long-Term

While long-term capital gains have separate federal tax brackets and do not affect the calculation of gross income for the year, the amount of taxes paid on long-term capital gains does depend on an individual’s gross income.

There are 3 different federal tax brackets for long-term capital gains: 0%, 15%, and 20%.

Long-Term Capital Gains Tax Rates

Single – Under $40,000 – 0%, $40,000 to $441,450 – 15%, $441,450 and above – 20%

Married, File Jointly – Under $80,000 – 0%, $80,000 to $496,600 – 15%, $496,600 and above – 20%

Head of Household – Under $53,000 – 0%, $53,000 to $469,050 – 15%, $469,050 and above – 20%

Married, File Separately – Under $40,000 – 0%, $40,000 to $248,300 – 15%, $248,300 and above – 20%

State Tax Rates for Capital Gains

Short-Term

Calculating state tax rates for capital gains is often much more complex since many states have completely different regulations for determining capital gains taxes, with many providing special tax treatment options for capital gains unique to the state.

Also, the lines between short-term and long-term capital gains taxes on the state level often become blurred due to the myriad of special tax treatment options available.

However, one of the main distinctions between short-term and long-term capital gains on the state level is the provisions contained in many states allowing some or all federal income tax to be deducted from taxable state income.

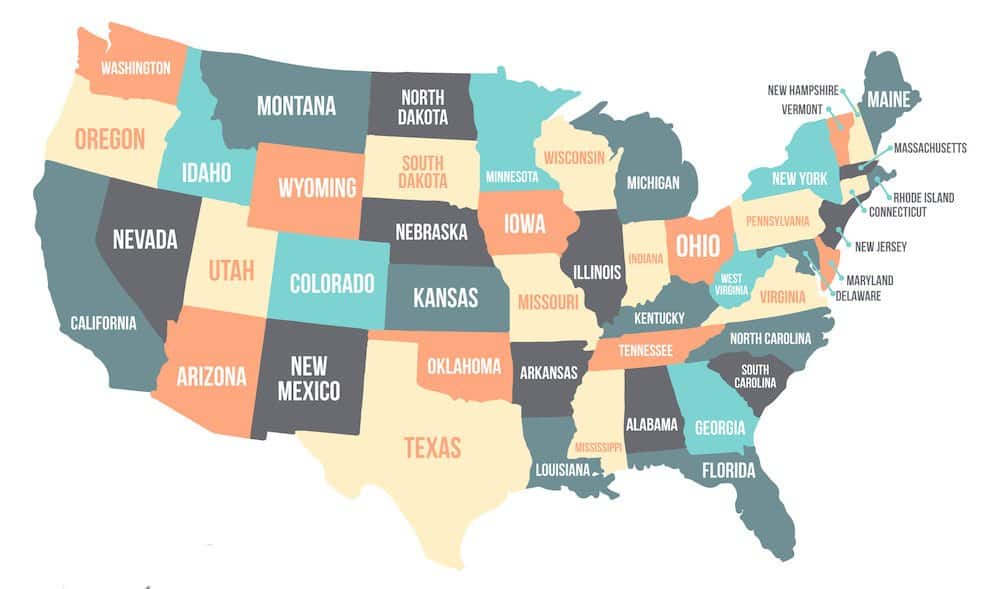

States including Alabama, Delaware, Iowa, Oregon, Montana, South Carolina, and Wisconsin currently have provisions for these deductions, directly impacting whether or not an individual may decide to cash in capital investments in the short-term or long-term.

For example, a person may not be as hesitant to incur a higher federal tax bracket for a specific tax year by cashing in short-term capital gains, if it means they can deduct a higher amount from their taxable state income, an option more attractive in states with higher income taxes.

Long-Term

Long-term capital gains taxes directly correspond to the state income tax rates, meaning that states with no income tax have no long-term capital gains taxes.

As a result, capital gains tax rates range anywhere from 0% in states with no income tax up to 13.3%, the highest state income tax bracket in California.

How to Save Money on Capital Gains Taxes

Long-Term > Short-Term

In most situations, the best way to save more money on capital gains taxes is to utilize long-term capital gains instead of short-term capital gains.

Because short-term capital gains are considered income, they can be taxed at the 37% federal income tax rate, whereas long-term capital gains have a separate category of tax rates whose highest rate is only 20%.

Short-term capital gains also can incur additional tax increases if these gains put the individual’s gross income into a higher tax bracket.

The 12% to 22% tax bracket increase is particularly burdensome on most middle-class Americans, as simply going from $40,000 to $41,000 can almost double the federal income tax bill on short-term capital gains.

State Capital Gain Tax Rates and Regulations

Another way to save money is to become familiar with the complexities of state law surrounding both short-term and long-term capital gains and move to a more investment-friendly state.

Because of the great variance in state income taxes throughout the United States, many states pose significant financial advantages for both short-term and long-term capital gains. 9 states, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming currently have no capital gains tax, making them an ideal location for investors.

Other states with low capital gains rates include North Dakota, Pennsylvania, and Indiana whose highest rates are 2.9%, 3.07%, and 3.23% respectively. Finally, Michigan, Arizona, Colorado, Ohio, New Mexico, Utah, Illinois, Oklahoma, Mississippi, Massachusetts, Kentucky, and Alabama all have investor-friendly rates ranging from 4.25% to 5%.

States to avoid for the purposes for income tax purposes surrounding short-term and long-term capital gains include California, whose highest long-term capital gains rate is 13.3%, Hawaii, whose highest rate is 11%, New Jersey, whose highest rate is 10.75%, Oregon, whose highest rate is 9.9%, and Minnesota, whose highest rate is 9.85%.

Other states that are not ideal for investing include South Carolina, Maine, Wisconsin, Iowa, Vermont, and New York, whose highest rates range from 7% to 8.82%.

The investment desirability of some states may also be enhanced by tax regulations allowing individuals to deduct federal income tax from taxable state income among other perks.

Don’t Automatically Use Cash for Charitable Giving

When most people contribute to a charity, they end up contributing cash through either currency or a check.

However, donating stock that has increased in value to a charitable organization will eliminate the capital gains tax on the stock, which depending on the timeframe of the stock sold and individual’s tax bracket, could save a lot of money.

Best of all, the charity doesn’t have to pay any taxes on the increase in stock value either, making it a much better option to contribute than simply cash.

Exemption Limits for Capital Gains Taxes

Probably the most significant practical exemption limit for taxation on capital gains is the sale of a home.

The IRS allows individuals to exclude $250,000 from the sale of a home from capital gains taxes, with certain joint provisions between a couple sometimes allowing up to $500,000 to be exempt.

However, the seller(s) must meet 3 different requirements:

- The individual or couple must have owned the home for at least 2 years during the previous 5 years ending on the date of the sale

- The individual or couple must have used the home as their main residency for at least 2 years during the previous 5 years ending on the date of the sale

- The individual or couple must not have already used this same exemption provision during the 2 years they resided in the home they are currently selling

Individuals or couples that fail to meet the requirements for the $250,000 or $500,000 exemption may still qualify for a reduced exemption rate.

Special Rates and Rules

In addition to the special exemption rate for the sale of a home, many other unique provisions govern the sale of other capital assets.

Any appreciation in value from purchased collectibles including art, antique items, jewelry/precious metals, and even stamp collections must pay a 28% tax regardless of the individual’s gross income.

Qualified small business stock (QSBS) is also treated much differently than traditional capital gains, completely exempt from all federal taxation. For a stock to qualify as a QSBS, it must have been purchased from a qualified small business after August 10, 1993, and have been held by the investor for at least 5 years.

This exemption from federal taxation is limited to either $10 million or 10 times the adjusted basis of the stock, whichever financial consideration is greater.

Additional capital gains above this amount are subject to a 28% taxation rate.