Finding the best forex trading system for your goals, based on your risk tolerance and profit goals, can be tremendously helpful in following a systematic thought process when trading.

We all know how emotional trading can be, which is why most beginners don’t follow any type of trading system, don’t make that mistake.

Leave your emotions on the bench, and follow one of these popular and proven Forex trading systems to get you ahead, and most importantly, making predictable profits.

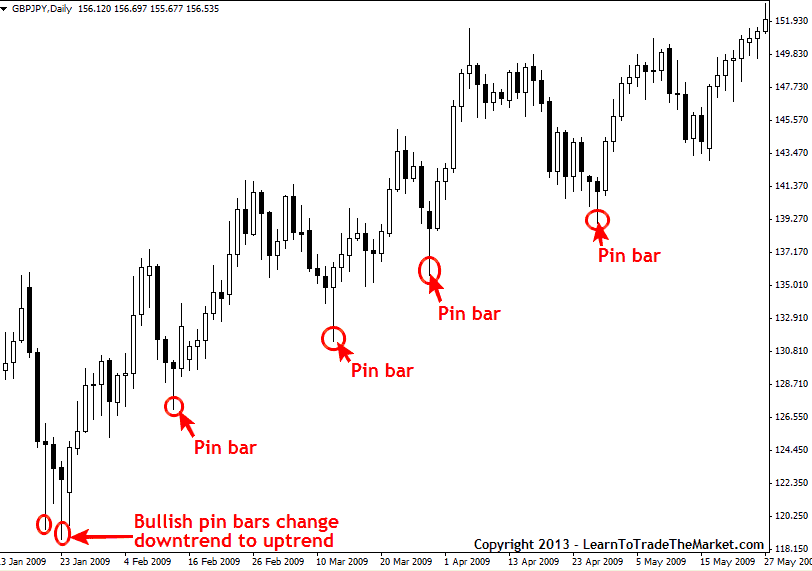

1. Pin Bar Trading Strategy

The pin bar formation indicates where a price point or a certain level in the market was rejected.

It is among the best Forex strategy for beginners because once they familiarize with its pattern, they can easily analyze the market.

It is a one price bar that represents the rejection of price and a sharp reversal.

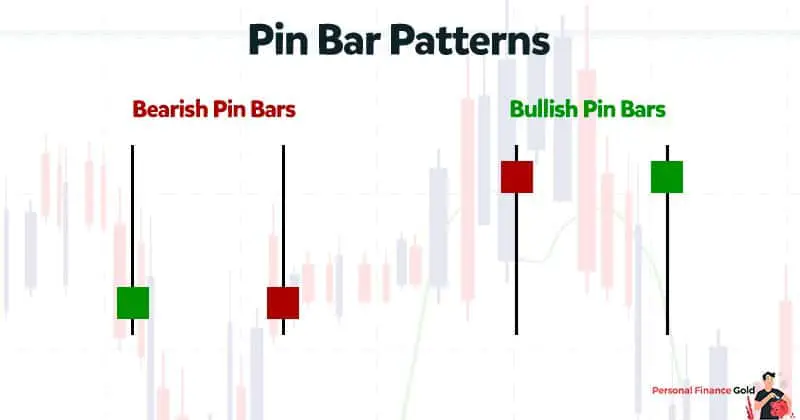

There are two types of pin bars: bearish and bullish reversal pin.

- In the bearish setup, the tail points up because it shows the rejection of a level of resistance or higher prices.

- In the bullish setup, the tail points down because it shows the rejection of a level of support or rejection of lower prices.

For instance, in the above chart, you will notice that during a rally, the market came into resistance.

However, it was able to break through this resistance to trend upwards true to the basic principle; the former resistance becomes new support. Just as indicated by the bullish pin bar, the market was able to find support at the previous resistance level.

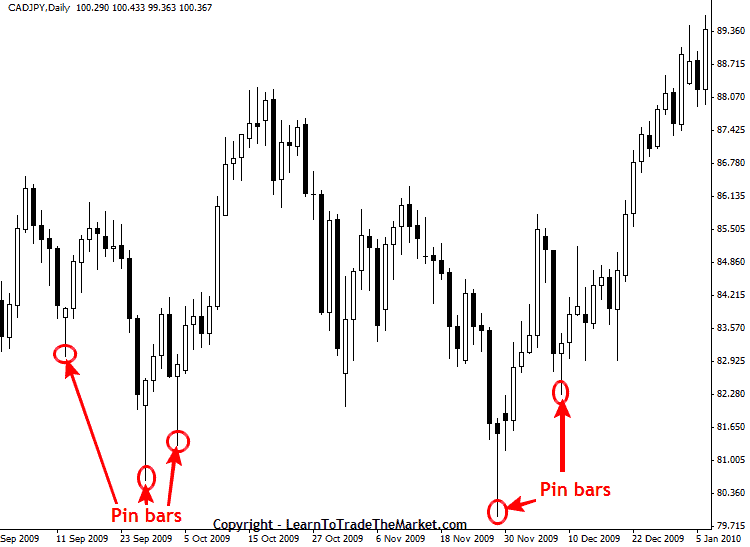

The following chart of CAD/JPY presents the two types of pin bar formation in action.

An important thing to note is how the tails of the pin bars projected from the surrounding price action i.e. rejection of higher or lower prices.

Pros

- Easy to use

- Has a gentle learning curve

- When used properly there is high potential for profitability

Cons

- Beginners sometimes find it difficult to understand the use of the same candle bar as a reversal and continuation at the same time.

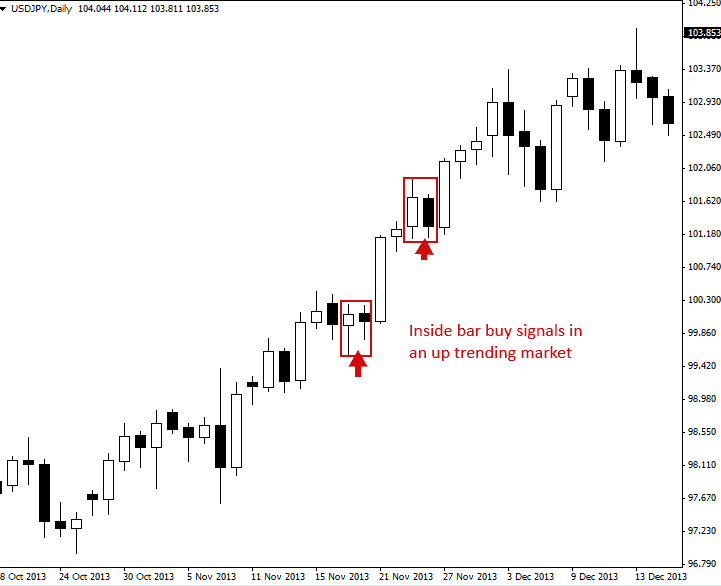

2. Inside Bar Trading Strategy

The inside bar trading strategy uses a two-bar candlestick pattern, to indicate price consolidation or rather a continuation of the pattern.

So, when traders see an inside bar, in a chart they use a pending order trade a breakout in favor of the current trend.

To spot an inside bar in a chart, the preceding bar is much larger in size. The larger bar is called the mother bar because it overshadows the inside bar.

Just as earlier mentioned, they mostly represent market consolidation points (where market pauses to consider its next move) especially following a big change in the market.

Inside bars can also found at the turning points of the market to act as reversal signals for resistance levels or key support.

The following is a USDJPY daily chart shows an inside bar that marks the continuation of a major upwards trend.

In other instances inside bars can also indicate the beginning of a reverse-trend. In such cases, the inside bars act as reversal signals.

Pros

- Easy to understand and implement

- Ideal for new traders

- Has a good risk to ward ratio

Cons

- It works only on trending periods

Takeaway: It will require patience for beginners to develop enough skills to get a constant stream of income.

3. Breakout Consolidation

Breakout Consolidation happens when markets fall between the bands of resistance and support.

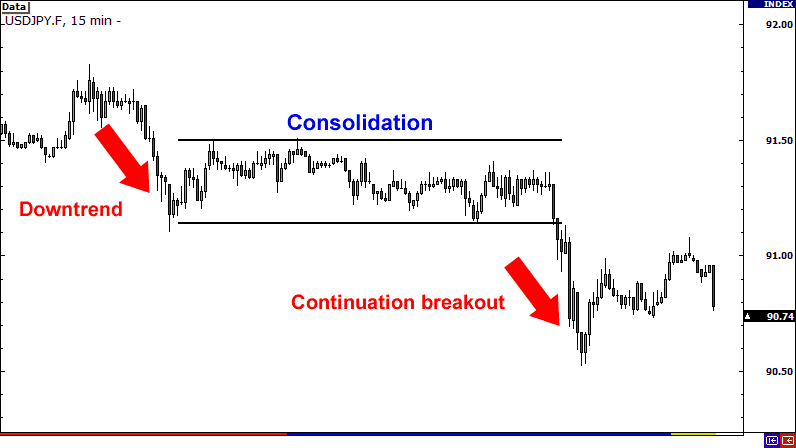

The chart above illustrates the consolidation and breakout.

On the other hand, when the market moves beyond its consolidation boundaries to new highs and lows, a breakout occurs.

A breakout happens every time a new trend is about to be created. As such, breakouts potentially indicate that a new trend has begun.

However, not all breakouts result in new trends; so traders need to do a thorough assessment of the market to minimize chances of loss during this period.

The use of the period length to determine the trend normally, a new low indicates the beginning of a downward trend while a new high indicates the possibility of an upward trend.

However, traders need to get a more accurate prediction of the trend they are about to enter.

They can achieve this by manipulating their breakout strategy to take advantage of the current trend.

A breakout that goes for a longer period beyond the lowest low or highest suggests a longer trend.

A short breakout period suggests a short-term trend.

So modifying their breakout strategy to react faster enables the trader to take advantage of the changing trend early enough. This way, traders can minimize profits, and minimize losses before the prevailing trend changes its direction.

Pros

- Has the potential to enable traders to attain some of the largest profits.

Cons

- The major disadvantage of this strategy is that it is hindered by its fair share of false signals.

- At times, new lows may not lead to a new downtrend and the new highs may not result in a new uptrend.

Takeaway: To ease this problem, traders typically use a stop-loss. Stop-loss is a time-based approach where traders exit the trade after a certain period of time; which can be hours or even days. The traders play around with the timing to enter and exit trade against their previous the results of their moves to establish the choices that are profitable and then avoid the ones that are not.

4. Forex Breakout Strategy

We have established that a breakout is any price movement outside a specific resistance and support area.

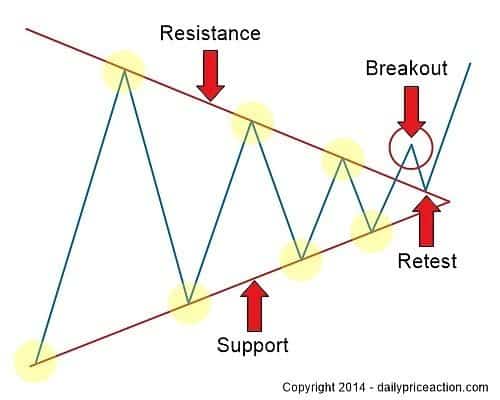

This strategy has four parts namely, support, resistance, breakout, and retest.

The illustration above presents how these four aspects work together to determine the market trend.

Though this illustration is very similar to that of a breakout, the major difference is that there are two trend lines; instead of having one horizontal line and one trend line.

One trend acts as resistance while the acts as a support to create a “wedge”. You will notice that the market creates a terminal wedge, which indicates that the pattern will eventually come to a close.

The best time to trade is when the market breaks to either side after which it retests the level as new resistance or support.

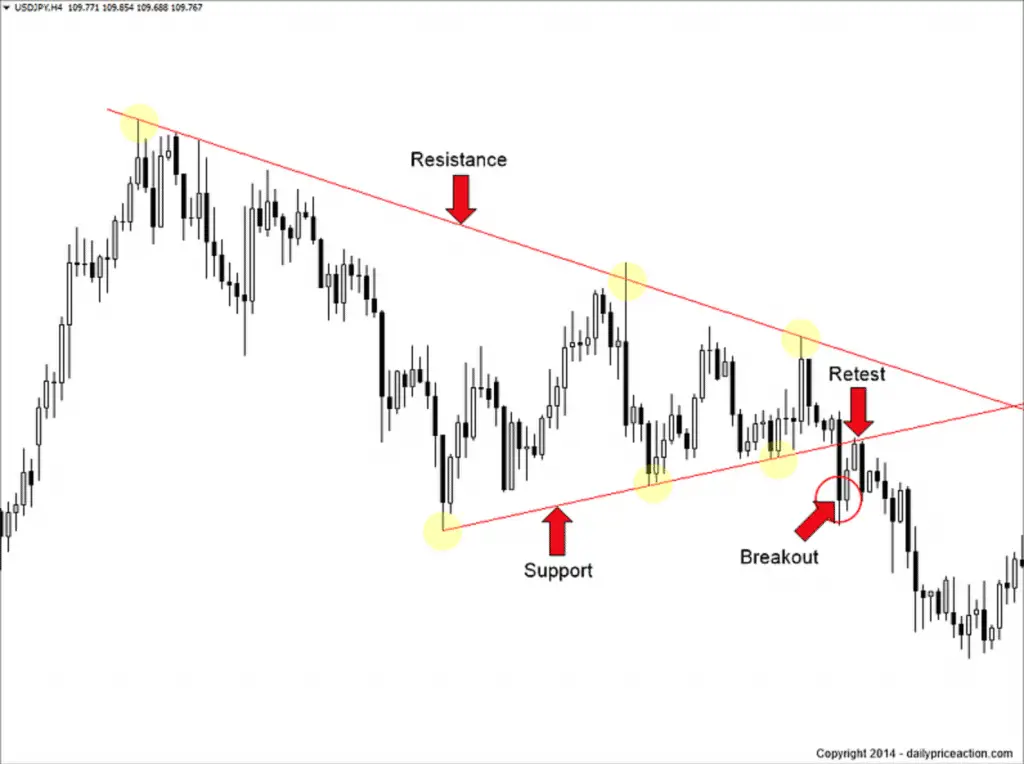

The following is an illustration of the Forex Breakout strategy pattern on a USDJPY 4-hour chart.

You will notice in the chart above, the market touched both the lower and the upper boundaries several times before breaking out on the lower side.

The Forex breakout strategy is one of the most effective strategies known to initiate large successful trades by allowing traders to get huge profits within a short period of time.

Pros

- Simple to use

- Reliable

- Has favorable risk to reward ratios

Cons

- New traders may face challenges to understand the right time to enter or exit the market.

Takeaway: The forex breakout strategy is different than most of other breakout strategies. It is not only simple to use and reliable but also has a favorable risk to reward ratios.

5. Moving Average Crossover

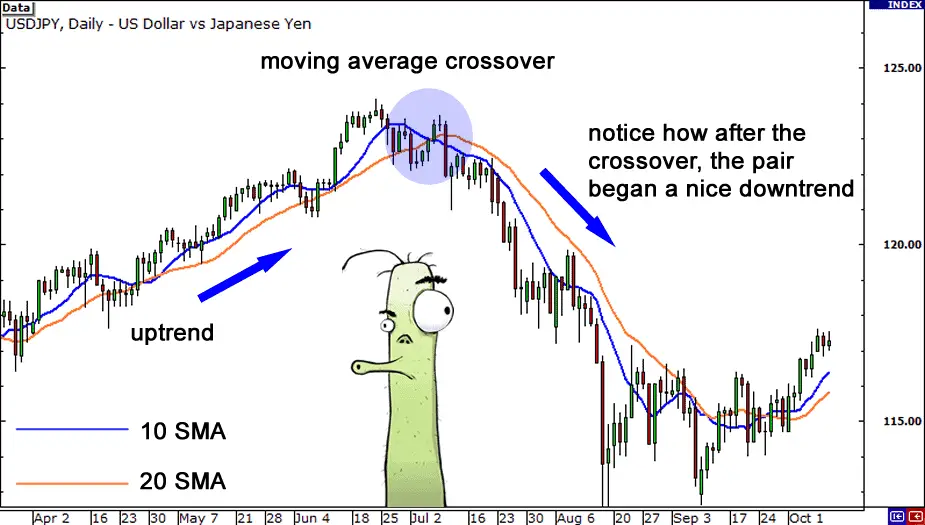

Moving Average is among the oldest form of technical analysis used to assess trends and to date, it is a commonly used indicator.

Moving averages simply smoothen out price action over a period of time. In other words, it reduces the market noise or rather fluctuations that make obtaining accurate real-time exchange rate data difficult.

By smoothening these fluctuations, it becomes easier to validate and identify potential market rate trends from the price fluctuations found in all currency pairs.

More technically speaking, it involves obtaining the average closing price of a currency pair within a particular period.

It is used by traders to forecast future prices by studying the slope of the moving average to determine the possible direction the market prices will take.

Having a smoother moving average means that the price movement in the market is slow. On the other hand, a noisy moving average means that it reacts to the price movement faster.

A smooth moving average is more desirable to make more accurate predictions; it is achieved by obtaining the closing prices average over a longer time period. There are various types of moving averages with each having its own level of “smoothness”.

One of the major functions of moving averages is to identify the current market trends. This also includes generating actual trading signals and identifying resistance levels.

The easiest way to achieve this is to plot the moving averages on a chart. The moving average slope can be used to gauge the strength of the trend.

A price UPTREND occurs when the price movement remains above the moving average.

On the other hand, in a DOWNTREND, price action is normally below the moving average.

Moving Average Crossovers are used to determine when to enter or exit a trade. This is mainly triggered by a crossover that occurs when the short-term moving averages either crosses above or below the long-term moving averages.

A crossover is often a signal that the trend is about to change. This gives traders a chance to get a good entry.

Pros

- Smoothens out price action

- Simple to use and understand

- Generates the actual trading signals and is also effective in identifying resistance levels

Cons

- They only confirm established trends and not predict new trends

Takeaway: An important thing to note when using moving averages to establish the trend is that they are lagging indicators; they confirm established trends and not predict new trends. Many technical analysts and traders often consider holding a long position in an asset and analyzing multiple moving averages when trying to establish long-term trends.

6. Carry Trade

Carry trade entails profiting from the difference in yield between two currencies.

In other words, you make a profit if the currency does not fluctuate for a long time. It involves borrowing a currency at a low-interest rate and then selling it at a higher interest rate.

This means while you are paying low-interest rates on the currency you borrowed, you get a higher interest rate when you sell it or lend it out.

So in this case, profits come from the interest rate differential. It’s simple arbitrage.

Here is an example of a carry trade:

- You borrow $10,000 from a bank at an interest rate of 1%.

- With this cash, you purchase a bond that pays 5% interest per year

- This means you get a profit of 4% per year.

Though this does not sound like a lot of return on investment; when the same concept is applied to the spot forex market, with its daily interest payments and higher leverage, you can reap huge returns.

Pros

- When implemented right, it is a good source of huge passive profit.

- It is easy to understand and implement.

Cons

- Currency fluctuations pose a risk to profitability. In case the value of the base currency appreciates enough against the second currency that you are trading with, you are likely to incur losses.

Takeaway: This strategy works well when you carefully select the right currencies i.e. stable currencies.

7. Keep It Simple Stupid (K.I.S.S)

Just as the name suggests, it is all about keeping all aspects of your Forex trading simple, from the way you execute your trades to the way you analyze the price movement.

To achieve this, you should stop looking for the perfect trading system and instead focus on learning how to analyze raw data from the price charts.

This way you will learn both the art and the skill to take you to the next level as a forex trader.

Learning the art of the trade will enable to make a decent living out your calculated moves. Coupling this with the skill of price pattern recognition will give you an angle that will create an effective trading method that optimally suits your needs.

With this method, you will be able to make sense of the market regardless of the market chaos that comes your way.

Interestingly enough, the most accomplished traders adhere to the idea of keeping it simple. They did not make their millions in this industry through the use of the most sophisticated lagging indicators or complicated trading software.

Instead, they attained their success by adopting a flexible market perspective that was nurtured through practical trading experience.

However, most of the experienced but unsuccessful traders and the beginners often complicate the trading process.

Simplicity helps traders to focus on more complex aspect of the trade such as proper risk management and maintaining discipline.

Pros

- The only method with a guarantee for success in the forex market when properly implemented

- Simplicity

Cons

- None

Takeaway: Traders must always adhere to their trading system rules; this way they are assured of success in the forex market. Moreover, the K.I.S.S method provides and effective guide on how to navigate the forex market by adopting simplicity in the trading action. The grave mistake traders make is to complicate trading by forcing a set of strict indicator based trading rules.

Conclusion

Now that you’ve reviewed all the strategies listed, go back and review each of the pros/cons again if you need.

If used properly, they can quickly build your trading account into a sizeable amount. The best part is, they are extremely simple to understand and are therefore easy to incorporate into your trading plan.

Here are a few key points from the lesson:

- The pin bar trading strategy is best traded as a reversal pattern in the direction of the major trend

- The inside bar trading strategy is best traded as a continuation pattern

- The Forex breakout strategy should be traded after a break and retest of either support or resistance

- All you really need to become profitable trading Forex is two or three great trading strategies

Then pick 1 of the strategies, and put it into action. This way you’ll see if you can work with the strategy with a few tweaks, or need to come back here and find another that works better for you.

Best of luck!