With over 30 million people unemployed in America right now, it’s tough to face the bills that come on a regular basis.

If you’re currently unemployed, please visit the national unemployment website to get resources from the Government.

Saving money is the absolutely most important thing you can do to set yourself up with a coushin for any future blows, if you have never started, please start planning for saving today (even if you don’t have the funds yet).

Money is tight for almost everyone, so I wanted to share some ideas in how you can utilize the money you do have to make it last long, or find ways to push upcoming payments so you can find a way to get some more money.

1) List out all your expenses on paper

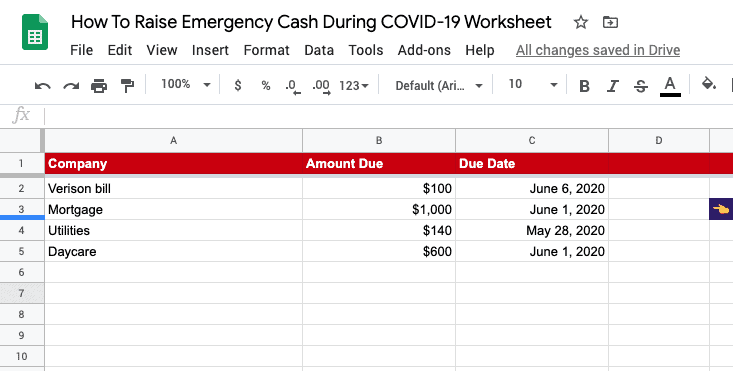

Let’s first get clear about exactly what you owe soon, how much, and if you can also write down the payment deadline date.

Typical costs you’d list are:

- Mortgage/rent

- Credit card bills

- Daycare

- Utilities

- Subscription services like Netflix/Spotify

- Phone bill

- Car insurance

- Car payment

What we didn’t add are typical monthly costs like groceries and gas. You can get creative on how to get the most and spend the least with things like that, you can’t do the same for your mortgage or rent.

I made a Google Sheet doc for you with several examples to help you get started.

2) Contact these companies to ask for an extension or payment plan

They know everyone is hurting right now, and almost all companies are sympathetic to their customer’s cash flow issues.

Once you listed out all your hard bills above, with the dollar number and due date, organize it by due date so you can see which company you have to contact first.

The company’s goal is to collect payment from you, so asking for an extension or a payment plan is okay.

I would contact every company on the list to ask for an extension, so you can have money now for the most urgent needs like groceries and keeping your lights on.

3) Review your existing emergency fund

Go over your current emergency fund to see how much you have, and how long it can last you.

Are your funds in different locations? Are they all mostly liquid and available within a day or two if you needed it?

If you have $10,000 in your emergency fund, and your monthly expenses are $3,000, then you have just over 3 months of savings until your funds are depleted.

If you were able to get extensions on your monthly payments, and it brought down your monthly expenses to $2,000, you were able to just extend your emergency fund to 5 months!!

You added 2 months by just getting extensions on your payments.

4) Sell the things you don’t need

Whether it’s on Facebook Marketplace or on eBay, find things you don’t need that might be valuable and sell them online.

While everyone’s at home, everyone’s online. So these marketplaces are buzzing with people who are buying and selling.

If you haven’t used something in your house in the last 1-2 months, you most likely won’t miss it if its gone.

5) Use your credit card

This is ranked #5 because I want you to use it as little as possible.

A great emergency fund in this age is to have a high balance credit card that is mostly paid off.

You can rely on it to take care of almost all your bills. Even phone bills and some utilities can be paid from your credit card.

Things like car payment, mortgage, and daycare fees will all go directly to ACH, so the money has to be in your bank.

You could put a small balance for groceries, gas, and other necessities on your credit card, acting as your emergency fund.

If this is an older card, you can ask your company to give you a temporary reduction in APR, so you’re not getting into debt using this method.

If you have fairly good credit, then you could opt to just sign up for a new credit card, that would usually have a promotion for 0% APR for a year.

6) Home Equity Line of Credit (HELOC)

Another option that I put way on the bottom of the list, and only applicable if you own a house.

You could take money out of your home and use that for your emergency needs, this is called a HELOC.

Every time you pay your mortgage payment, some of it goes to interest, and some go to your principal.

You’re paying down the mortgage of your home, and if you ever needed to, you could borrow back that principle money at an interest.

If your home cost $200,000 and you had it paid down to $160,000 then you could get a HELOC for the $40,000 difference.

Just remember that you’re mortgage will go back to $200,000 and you’re also going to pay interest on the $40,000.

Knowing this, I would do everything else on this list before resorting to this method.

In times like this, get creative 🤔

I listed a few popular ways where you can get an idea of your expenses, delay them if possible, and also how to get money from credit cards and HELOC if you needed.

In times like this, you can also find ways to earn an income, whether that’s a side job like pizza delivery or an online gig at a freelancing website.