It’s about time we face the harsh reality, Americans suck at saving money, and you have probably fallen into those statistics without even knowing it. There are more consumers of goods and services here in the U.S. than in all of India. That’s over one billion people, and we still consume more than they do.

It has become a national culture, one of spending and not of saving. The automated one-click shopping and constant bombardment of consumerism make it even more challenging to save. There are more adverts targeted at you daily asking you to buy this and that than those encouraging you to put money away for your future. Global commerce giants like Amazon, Walmart, Costco, among several others, with the help of big data, are working tirelessly to make sure you spend more money.

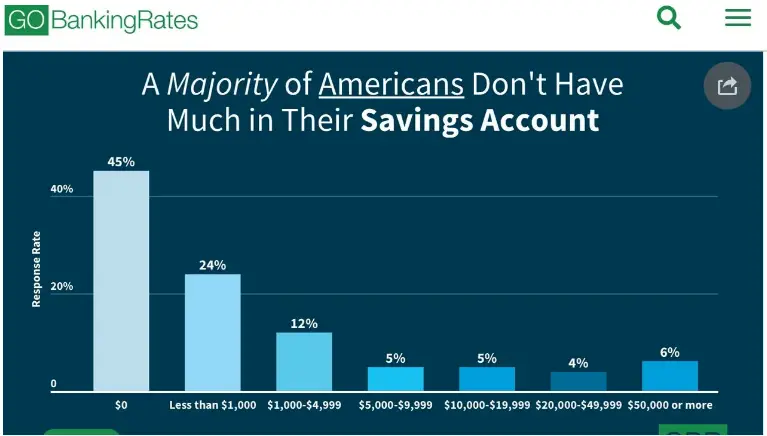

According to a recent survey by Go Banking Rates, almost 70% of Americans have less than $1,000 in a Savings Account.

It appears setting money aside for any futuristic purpose is hard for Americans, especially in 2019.

In 2017, 57% of respondents said they had less than $1,000 saved. There was an increase to that percentage by one in 2018.

Respondents’ rates were rounded to the nearest whole number (last updated December 2019)

In 2020, the percentage went up to 69%. Included in that figure are 45% of respondents who said they had absolutely nothing saved away.

It was particularly alarming because the percentage of people with $0 in savings has not been that high since 2014, when the survey was first carried out.

Other significant findings from the survey are:

- The main reason respondents claimed for their difficulty in saving is because they were living from paycheck to paycheck. Almost 33% said this was the main challenge preventing them from saving, and about 20% ascribed the reason to the high cost of living.

- When asked what would make them save more, most respondents’ top list is a higher salary. About 38% of respondents said earning a high salary would help them save more, while 18% said lowering their debts would allow them to set aside extra cash.

- The most common place where those with little savings put their cash is a savings account. 33% of respondents said they took advantage of their savings account to store their cash. 29% said they don’t have any savings.

The situation gets even more interesting when you try to picture it by demography. See the table below for a better understanding.

How Much Money Do You Have in Your Savings Accounts?

| Demographic | $0 | < $1,000 | $1,000 to $4,999 | $5,000 to $9,999 | $10,000 to $19,999 | $20,000 to $49,000 | > $50,000 |

| Ages 18 – 24 | 41.13% | 26.24% | 14.18% | 6.38% | 5.67% | 2.13% | 4.26% |

| Ages 25 – 34 | 50% | 21.15% | 14.42% | 3.85% | 5.77% | 1.92% | 2.88% |

| Ages 35 – 44 | 40.91% | 29.09% | 12.73% | 3.64% | 5.45% | 1.82% | 6.36% |

| Ages 45 – 54 | 53.29% | 20.39% | 9.87% | 5.92% | 2.63% | 2.63% | 5.26% |

| Ages 55 – 64 | 40.24% | 26.22% | 13.41% | 3.05% | 7.32% | 3.66% | 6.10% |

| Women | 50.56% | 22.94% | 10.24% | 4.23% | 4.01% | 2.90% | 5.12% |

| Men | 38.29% | 25.44% | 13.10% | 5.29% | 6.30% | 4.28% | 7.30% |

The table above, extracted from the survey, shows that Women and middle-aged adults find it more challenging to save money.

We have 51% of women versus 38% of men with $0 in their savings account, and 53% of respondents ages 45 – 54 have zero savings, the highest in any age group.

“It’s puzzling to me that if the economy is doing so well and that we’re so close to full employment, that consumer confidence is up … that we haven’t seen the numbers move much in people’s ability to save,” said Bruce McClary, spokesman for the National Foundation for Credit Counseling, which conducts an annual financial literacy survey. “I find it very troubling that people can’t come up with $1,000 in a savings account to cover expenses without borrowing money,” McClary said. In fact, having $1,000 in savings wouldn’t create enough of a cushion to cover many emergency expenses. That amount would just be “the starting point in the journey for achieving financial security — it shouldn’t be the final goal,” McClary said.

Here’s Why You Find It Hard to Save

Stats like these make you wonder why people find it challenging to save, and as we have read earlier, several people believe if they earned more money, they would save more. That may not be entirely true.

Here are some reasons why people are not saving enough.

1. No Budget Habit

A budget is a financial plan showing your income and expenditure, especially how you intend to spend it before receiving it, not after you have spent it. So, if you don’t have a budget or are working with a poor budget, it may be why you are unable to save.

A reasonable budget can help you manage your personal and family finance better. It’s pretty easy to achieve, and it can change the way you spend money from this moment if you do it right.

You can categorize all your expenses and income on a budget, starting with the most relevant expenses. For example:

Category 1 – Vitals. These are possible recurring expenses that must be planned for like, rent, feeding, transportation, gas, phone bills, electricity bills, Mortgage, debts.

Category 2 – Savings and Investments. After budgeting for your necessary expenses, next, you plan what percentage of what is left you want to save or invest.

Category 3 – This group contains less important expenses like an evening out with friends, luxury items, and others. You get the point.

The point here is to have this list prepared with a possible amount allocated to each item and ensure that you do not spend more than you have budgeted on each expense.

For some people, they will treat category 2 first and allocate what is left to other categories. If you find yourself falling short on items in category 2, you can always squeeze a little out of category 3 to cover the deficit.

When you start using a budget and following it strictly, you will quickly realize where you have been wrong in your finances and start fixing them.

Most people are afraid of budgeting because it will reveal how reckless they have been with their income. But you must face your fears and start correcting them from now by introducing a budget into your decision.

Develop a discipline that you will never spend money on anything you did not budget for, and you will see your impulsive spending drop very quickly. You will even be surprised at how much more you will be able to save.

If your budgeting sucks or you’re struggling at it, go to your App World on your mobile, you will find an easy-to-use budgeting app you can start using right away.

Most of these apps will do the computation for you; so, you don’t need to worry about the math.

2. Entitlement Culture

How often have you convinced yourself of the need for a reward when you need to spend some amount you didn’t plan for?

Sometimes, after a bad or stressful day at work, you stop by an expensive restaurant for a nice meal or end up at the club for a lovely time.

However, it has gradually developed into a habit you can no longer control, and you keep burning away your hard-earned dollars.

Just because you had a stressful or bad day doesn’t mean you should indulge in impulsive spending. Follow your budget strictly, and you will be better for it eventually.

Think about how often you spend that type of money and what it would have done to your savings or debts settlement.

Most of the items you end up buying without prior plans are the ones you never used because initially, you never had any use for them.

The same applies to the money spent clubbing and eating at expensive restaurants; you will later discover that you were burning so much money for little satisfaction.

3. Confusing “Wants” with “Needs”

Knowing the difference between wants and needs will go a long way in playing a vital role in your finances, especially how you spend money, but what I have noticed is that many people still confuse the two.

So, let’s look at a simplified example. Needs are essentials, and they are necessities of life. You need them to keep going.

I can even go as far as saying you require them to stay alive. On the other hand, Wants are desires. They are those items that improve the quality of life.

For example, when you are hungry, you need food, but after getting served that meal, you now feel it would be nice to enjoy it with a bottle of soda or an expensive drink.

The drink is not a necessity, and you can very well do without it. The meal is what mattered most.

Items like food, water, shelter often fall under needs, while other desired items like a new car stereo, designer wear, evening out with the boys or girls all fall under “want” that you can live without.

This is another way you can draw up your budget; break everything down to need and wants. I can guarantee you will find loopholes to block and save some extra dollars from them.

4. You Think Time is on Your Side – Procrastination

Here’s another top reason many fail to save, especially from an early age. This “I will start later” mentality led many astray, and they have since missed the mark and now live with regrets.

Several people have pushed their saving plans forward till “a better time” that never came.

How do you intend to manage emergencies when they come up? What about retirement plans? Do you have any?

There are loads of people out there like you living with regrets and wishing they had started putting away little money here and there and leveraged on the power of compound interest.

The good news here is that you can start today! Make the necessary painful adjustment in your finances and start saving today.

5. You Assumed What You Had Was Too Little to Save

This is another assumption that has prevented many people from saving anything.

You always want to wait for the big bucks before you can put some money aside, or maybe you’ve read or heard it somewhere that your tiny amount is insignificant when it comes to saving. That’s a great error!

Did you know that if you have started your savings with a $100 investment and added $50 every month for the past 20 years, you would have had close to $30,000 today? Yes, it’s true. It’s called the power of compound interest.

Your $100 investment and the $50 monthly contributions would have grown to $29,943.70. Out of that is a total interest of $17,843.70 at 8% annual compound interest. Your $50 monthly deposit would have grown into $12,000.

All you require here is the will and the discipline, and your money will do the rest by growing on its own without any further effort on your part.

6. You Feel You Don’t Earn Enough to Save

Before you claim you’re not earning enough to save anything, I must ask you how little you have tried to save from the little you’re complaining about.

If you are unfaithful with this little you believe you are earning, you will be even more unfaithful when you start making more. So, the discipline must start now.

Now let’s talk about earning extra income. How are you spending your extra time? Are you getting paid for it, or are you paying for it?

If you spend long hours playing video games, watching movies, or engaged in any form of activities that are not adding money to your account, then you are paying for your extra time.

On the other hand, if you spend your time freelancing and earning extra income, you are paid for your time.

You cannot earn extra income by just wishing for it; you need to work towards it. You may need to improve on skills you have or learn something new entirely.

Maybe you even need to make a yard sale to let go of some of those luxury items you spent money on and the other ones you don’t need.

There are several ways you can make money there day online and offline. You only need to show interest, and in no time, you will find something that works perfectly for you.

To stay afloat, your income must be more than your expenses. If your costs continue to be above your income, not only will you not be able to save, but you will also be in debt.

7. Your Debts are Preventing You from Saving

If you have lots of debts to deal with, it will be challenging to put money aside for your savings or investment, and if you are not strategic enough, you might spend a long time paying off those loans, and before you know it, you don’t have much time left to save.

So, to get out of debt earlier, you need to do something different to make money. You may need to get an extra job or sell something big to knock the loans with higher interest.

Another method you can consider is consolidating your loans and developing a better strategy and the portion of your income that will go into debt payment.

Another way out is if you have a business you are sure will work out well, you can take out something from your income or savings to set up this business for extra income.

This way, you will have extra income coming in to serve your debts and savings.

There are several ways you can make extra income if you are willing and ready to act.

8. You’re Spending Too Much on Entertainment

You will find it difficult to save if you continue to keep expenses you cannot afford. I used to love watching movies a lot. It was a hobby and a passion.

It was very predictable that if you needed to look for me, you could be sure I would be at the movies.

In addition to that, I had a Netflix subscription, and I was also paying for a cable TV subscription. Then one day, I sat down to scrutinize my expenses and why my savings was not growing as expected.

Here’s what I realized, I had been paying for my Netflix and cable TV subscriptions for many months without even opening the app or having time to sit and watch TV because they were all on recurring subscriptions. I had to cancel all subscriptions instantly.

While I’m not asking you to completely do away with your entertainment, I’m asking you to do a holistic review of your subscriptions and make some adjustments to boost your savings.

If you must keep that entertainment because it has become a habit, why not consider a shared subscription where you and your family and friends can share the cost instead of bearing the whole burden yourself.

9. You Treat Your Credit Cards as Income

In my many years of discussion of personal finance across several states and with people from all over the world, one common mistake I have noticed is how people treat credit cards as income or money earned.

So, they go ahead and spend out of control, exceeding limits and going out of control without considering the implication on their finances.

Your credit card is not money earned, they are loans from banks, and they come at high costs; and you need to start paying attention to these costs because they are significant reasons why your savings are dwindling.

When you buy on credit, you borrow from the bank pending when your income comes into your account.

Immediately, any funds enter your account, the bank deducts what you owe, including penalties and interest, and leaves you with what is left.

So, to save more, you need to stop using your credit cards to pay for items you don’t have the cash for. Spend what is yours so you can manage your budget better and have something to save.

10. The Influencer Effect

We are in the era of “influencers,” where people you follow influence how you behave and possibly how you spend your money.

It’s natural human behavior to follow an act, in the same manner, the person that influences you to act. So, when you see your favorite influencer spending big and showing off luxury, especially on social media, you will likely be tempted to follow suit.

The danger of following an influencer blindly is that you do not know the complete and real story. A lot of what you see is not exactly the way they are. Remember what they say about “if it looks too good to be true….”

You should never trust anyone completely and follow them blindly, especially when managing your finances. Stop the bandwagon effect of doing as they do and speaking as they do.

11. Buying on Installments

Another reason you are finding it difficult to save is because you are buying items and paying in installments. Here’s why installment payments may not be supporting your savings plans.

When you buy items to pay on installments, let’s say car, there’s usually a percentage mark up and interest. After the final payment, you would have spent a significant amount more on the car.

Try as much as you can to avoid buying on installments if you can, except when you have checked and realize there will be no difference in the final price compared with the prevailing market price for the same item.

Bottom Line

Where are you with your savings? Even if you find yourself derailing due to any of the situations mentioned above, or perhaps you don’t even have any savings or you don’t know how to start, you can start by looking at your habits and start changing your spending behavior by desisting from spending on items you do not need.

I admit that sometimes it might be challenging to make these adjustments on your own; that is why we have help available all over the place, from free to paid help.

For example, you can start your saving culture by subscribing to money apps that automatically deduct money from your account and save them on your behalf any time an income comes into your account.

If you can start controlling your feelings and spending behaviors, you will manage a budget and make more room for savings. The beauty of savings is that no amount is too little to start with.

The challenge is staying consistent. So start today and make savings a new habit and watch your finances take a turn for the better.