Personal finance may be comparable to planting a seed. At first, we get excited, for we have something to take care of. The excitement would motivate us to exert effort, give time and attention, looking forward to seeing the seed grow. The growth takes time though, that is why, some of us who cannot wait to see it grow and bear fruits, would either let it grow by itself (if it can survive on its own) or just forget the idea of even having it in the first place.

There are some of us though, who are patient and determined in achieving goals. We monitor the plant daily, water it, expose it to sunlight, and get rid of pests that may harm it. We know that one day, it will bear fruits that we’ll reap and enjoy.

This comparison exhibits the importance of investing time and effort in managing personal finances and to manage it effectively, we don’t just invest, budget, or save, but we keep track of its growth as well.

Why use a spreadsheet to track expenses?

Tracking expenses is an essential process in finance management. If we have a record of our income and expenses, we can clearly identify how we utilize our resources. Proper allocation and utilization of resources, will give us an idea of our financial health, and the probable time as to when we can achieve our goals.

Diligence is the key as monitoring will require complete and accurate records like receipts, withdrawal slips, and monthly billing statements. Manually recording every data in a notebook may work for some, but taking advantage of technology will save us more time and energy.

We can customize our own spreadsheet or download free templates to present our weekly or monthly data in one sight.

What should we include in our monthly budget spreadsheet?

As previously mentioned, creating a budget is important in organizing personal finance. To recall, here are the four steps in creating a budget:

- Note all sources of income

- Track the expenses including debts

- Stick to the budget plan

- Monitoring and updating the budget

3 main categories cover our expenses which are: needs, wants, savings and debt. Basically, how these 3 are identified vary on a case to case basis. Like clothing is initially categorized as a need, but regularly shopping for a luxurious bag may fall under a want.

What to include in our monthly expenses?

- Rent/Mortgage

- Utility bills include electricity, water, and even garbage disposal

- Emergency Fund

- Savings

- Debt

- Entertainment like internet, cable, app subscriptions

- Clothes

- Food

- Transportation

- Insurance/Retirement

We should also include a personal allowance for spending money so we won’t feel deprived and would not make impulse purchases.

How do I create a monthly budget spreadsheet?

Shop around for the program that fits you best

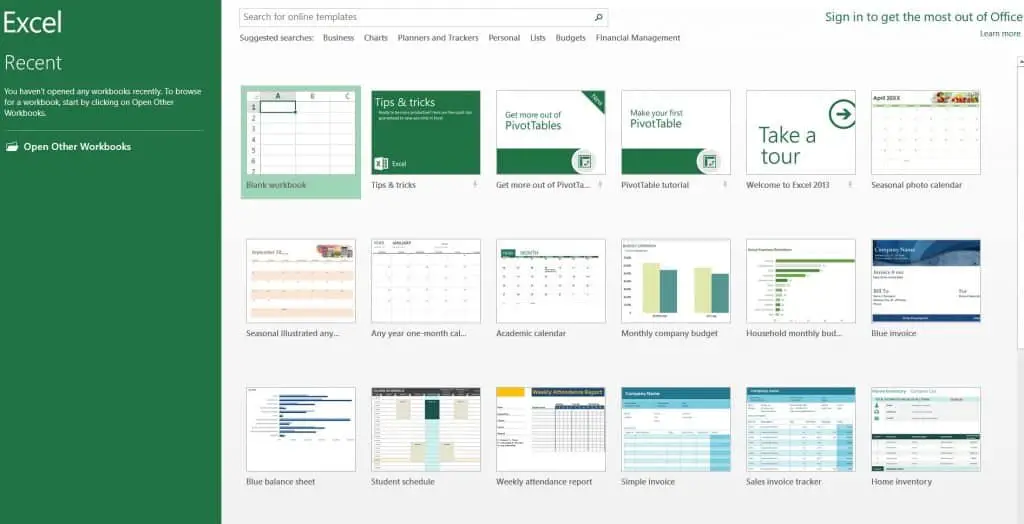

Different applications can make budgeting easier. Microsoft Excel and Google Sheets are the two best examples of spreadsheets that are readily available, depending on your device and your preference.

I personally like Google Sheets, as it’s free and I can access my spreadsheet on my phone too.

Choose a template

If you are clueless on how a Personal Budget Template looks like, you can search from the internet and find plenty of options online. From there, you can try to create your own, even design and color it according to your liking.

Templates are designed to depend on the user’s needs in creating a smooth flow, taking only a bit of your time and would only require a bit of typing.

Enter the data

Each spreadsheet has cells where you have to put the data for each category. This is the best time to input the expenses incurred for the month under each specific category.

You may enter specifics if you want to remember things easily like under food, you may put takeaway, restaurant meal, groceries, etc. You can freely add categories especially if it’s part of your regular expenses.

Verify the results

You can manually create formulas for your spreadsheet or you can make use of apps that offer automated calculations. Then, you can now have a vivid visual presentation of your income and expenses. Some apps would also include graphs for you to see how much of your income has been spent on listed categories.

It would be really helpful if you can track how the app resulted to the figures shown on the spreadsheet so you will have an idea on the formulas, then you can do it yourself.

Now that we have an idea in mind, let’s move on in creating that spreadsheet. There are various options that we can make use of, online and offline.

Examples of Budgeting Spreadsheets

Microsoft Excel

This software program is a spreadsheet system that can organize, format, and calculate data with formulas and make a financial analysis.

Microsoft Office also has readily available spreadsheets downloadable for free and customizable according to your needs.

Google Sheets

Google Sheets is a web-based spreadsheet tool (made by Google) that allows us to create spreadsheets and even share them. No need to worry about security issues also because they are protected by Google’s servers. Of course unless if you shared them, so be careful who you give access to.

Personal Note: Since I do 100% of my personal finances on my Google Sheets file, I organize and share my tax details with my accountant every year by giving him access to this file. Once the tax return is done, I remove access, so that it’s only me accessing the file again.

Vertex42 Spreadsheets

This is a nice site where you can get many free Excel templates. The spreadsheets are user-friendly and are already organized with listed categories that are clearly marked and divided accordingly. All that is left to do is to manually enter the data to each cell and it will instantly show results. No need to stress on formulas too!

Vertex42 also offers a wide range of spreadsheets depending on one’s needs.

Mint Lifestyle Spreadsheet Templates

Mint Lifestyle also offers budgeting sheets for free download. They also offer different budget templates that are also customizable.

How to create a simple budget spreadsheet in Excel

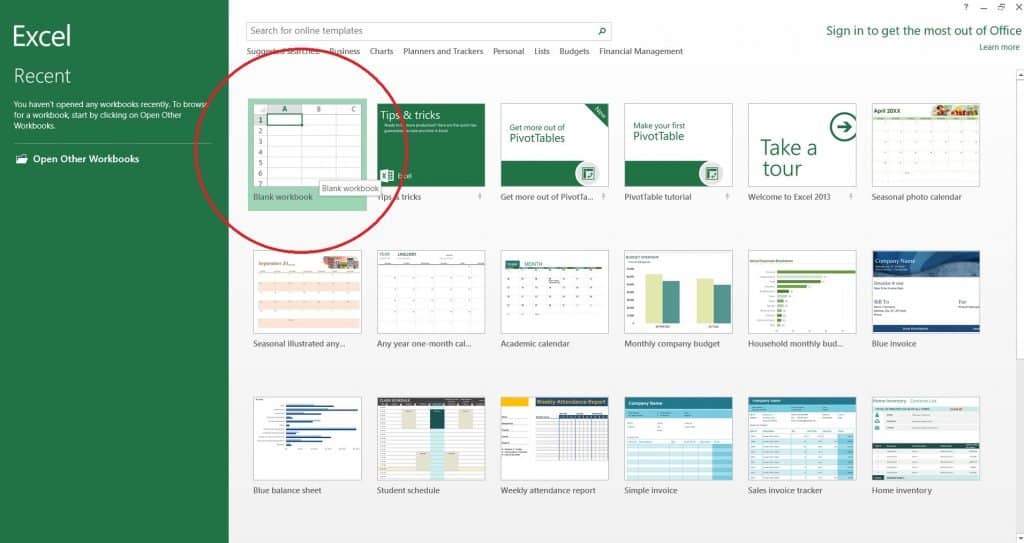

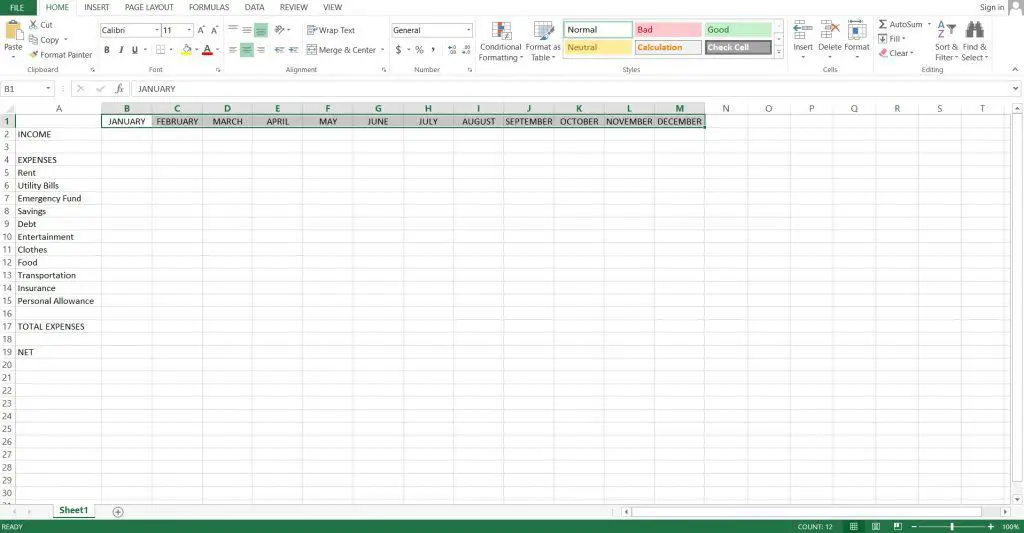

Step 1: Open your Microsoft Excel app that’s installed on your computer.

Step 2: Run the program and create a new spreadsheet.

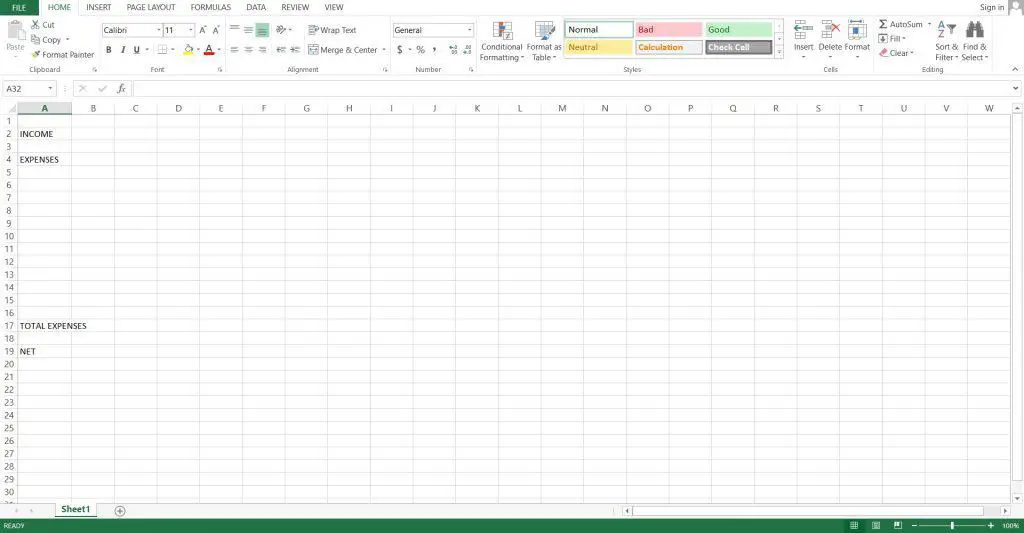

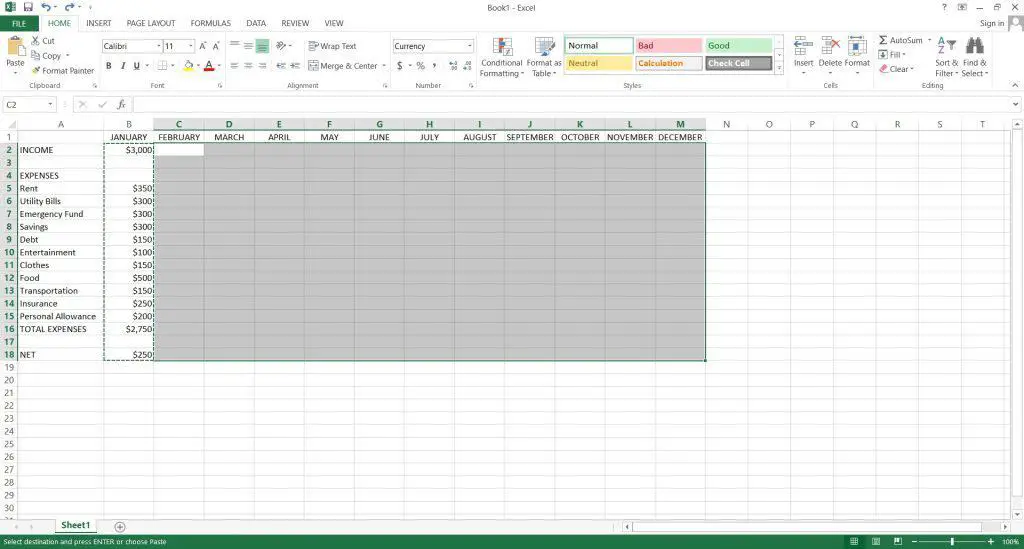

Step 3: Start by adding details in the “row” headings (Income, Expenses including Savings and Debt, and Net).

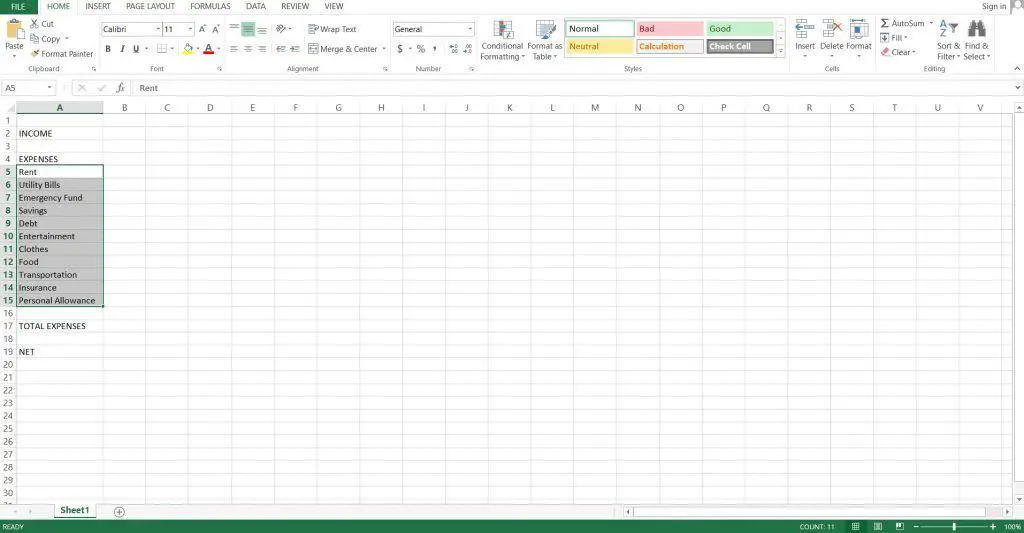

Step 4: Identify the categories for the expenses (food, rent, transportation, insurance, etc.). You can add or omit categories whenever needed.

Step 5: Indicate the months on the column headings depending on the coverage period (if it’s for the whole year, then encode January to December)

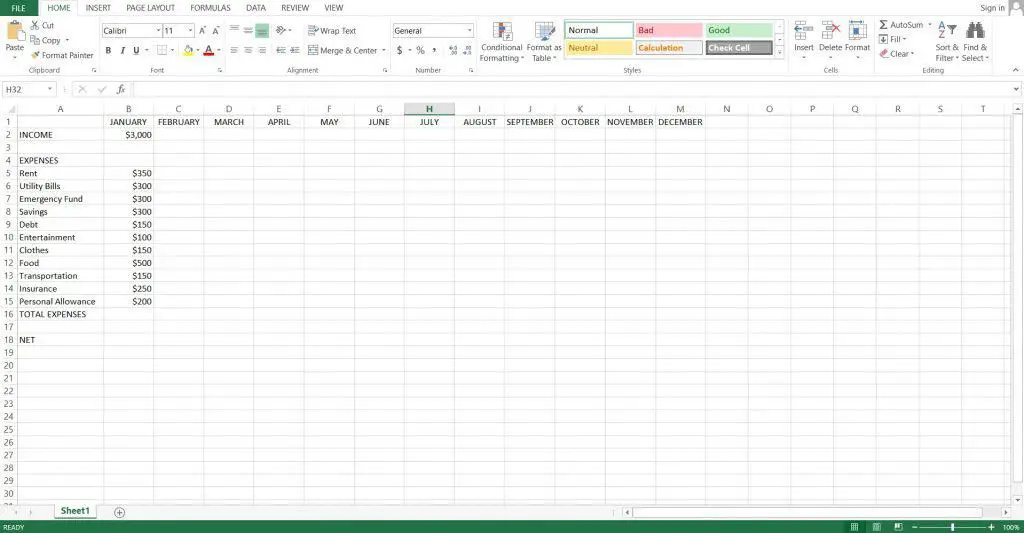

Step 6: Input the data corresponding to each category for each month including the Income and Expenses.

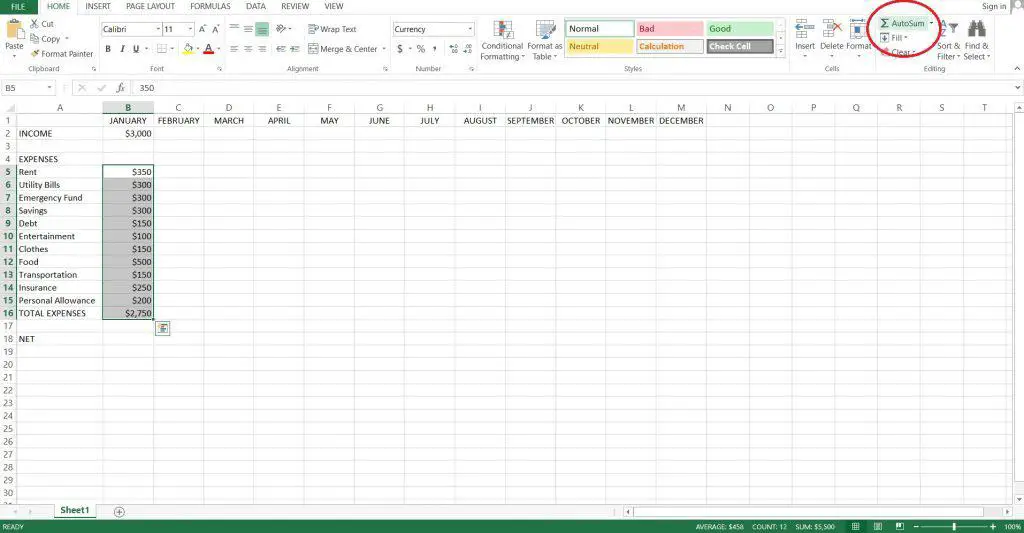

Step 7: Total the expenses. You can easily select the cells to be included in the total by highlighting them, then click Autosum.

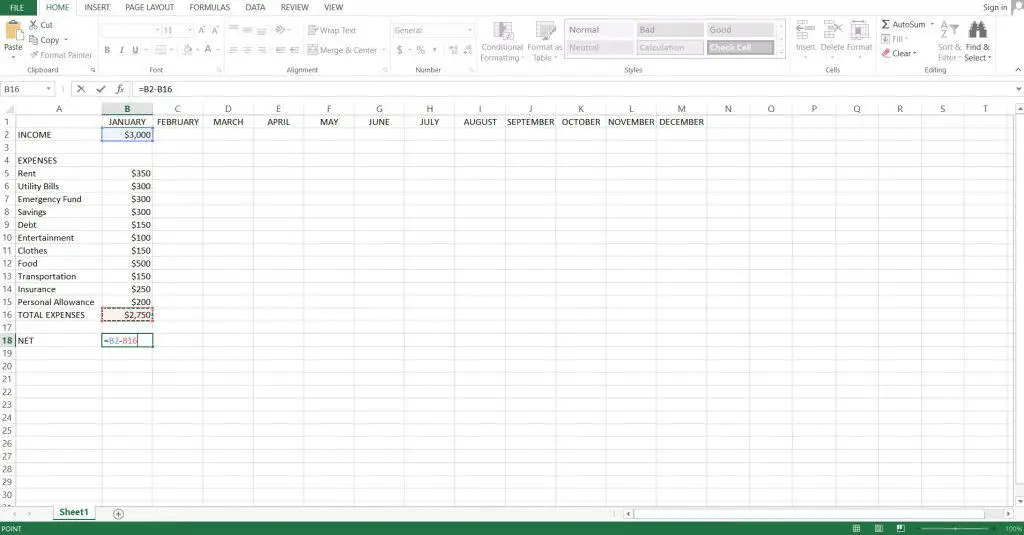

Step 8: Deduct the expenses from the Income to get your Net value.

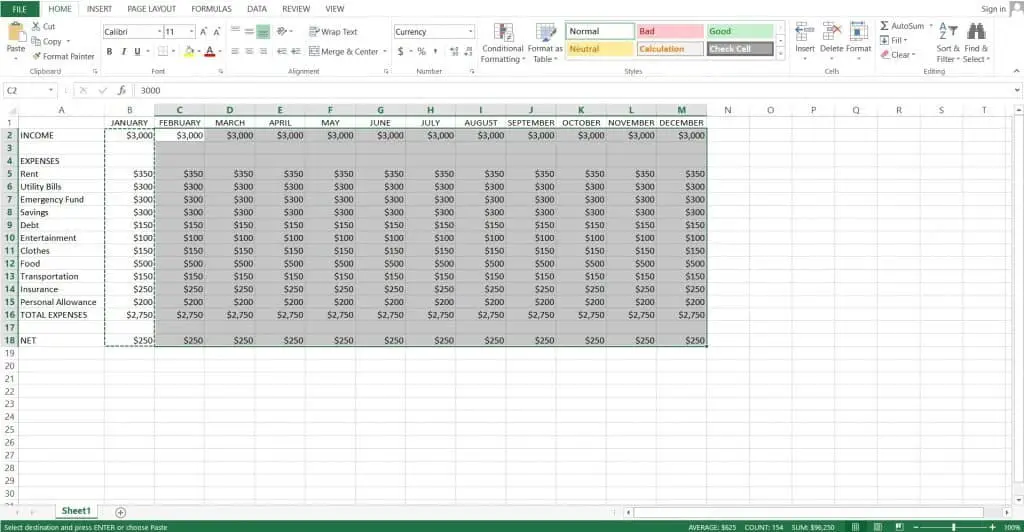

Step 9: Copy the data to the rest of the cell.

Step 10: Pasting the data for the rest of the months will create an automatic update given any value entered into the cell.

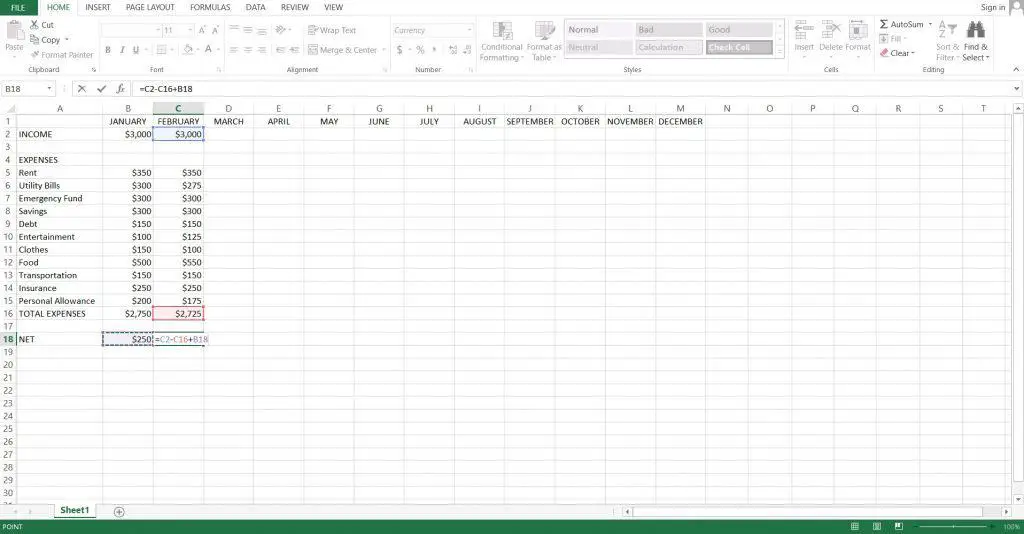

Step 11: Modify formulas when needed.

As shown in the example, you can add your previous net income to the present net value by adding it to the formula on C18.

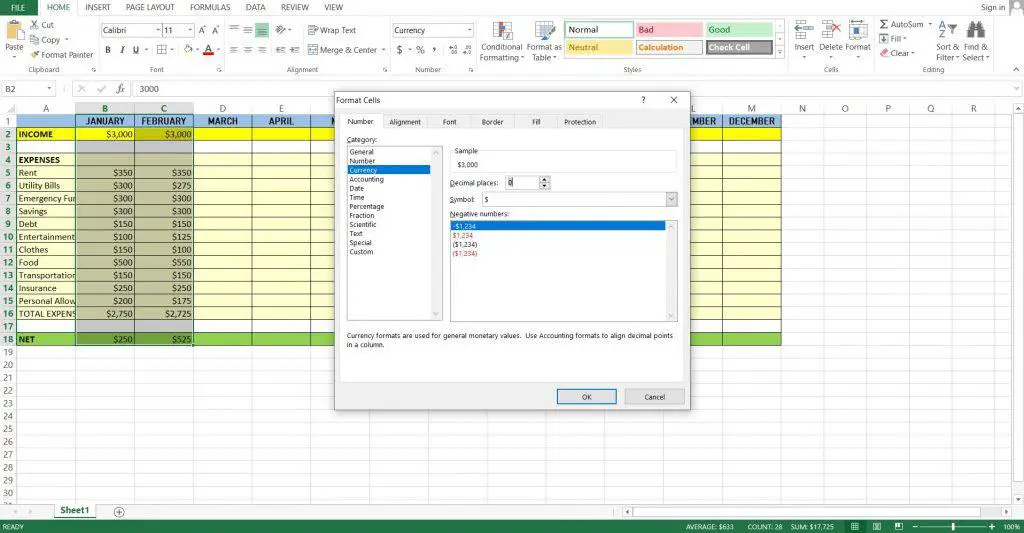

Step 12: Highlight and format the spreadsheet according to your preference. You can be creative in making your spreadsheet more appealing by adding colors and borders. This will also create a distinction making it easily understandable. Make sure to bold headings especially the Income, Total Expenses, and Net. You can also format the values into the applicable currency so you don’t have to manually type the currency sign every time.

You can also add charts or graphs depending on your choice. It would also be a helpful summary for you to visualize your financial status in a specific time frame.

Also, make sure to update your spreadsheet once in a while (I do it once a month on a specific date). Creating one spreadsheet to manage your personal finances is just the start. There will come a time where you have to create another sheet for investments or even mutual funds. You can also construct a checklist of your financial goals monthly on a spreadsheet for easy monitoring.

There are still a lot of tools that you can explore to make your life easier with budgeting using a spreadsheet. Don’t be content and push yourself to learn more because they aren’t really hard to use.

Final Thoughts

Identifying the different tools available and making use of one depending on our preference will be a starting point. Empty templates will serve as a guide until we can independently build and organize our own templates. Making a simple and understandable spreadsheet is key to keep up.

Trust me, once you’ve started it and clear data is presented to yourself, you will be more motivated and challenged to do better in handling your finances. You will crave that satisfying feeling of achieving even just small, short-term goals like paying your credit card debt on time.

Always put in mind though that in handling money, it is beneficial to be more familiar with how certain apps come up with certain values so we can be more involved in doing the math.