I’ve been managing my personal finances on Google Sheets since October 2015. I know that because I can see the first entry mark on my table. 😀

I have a habit of checking my personal finances on the 15th of every month. I have no idea why it’s the 15th, but over time it became the habit, and now I don’t question it. I just do.

To be honest, I actually used Microsoft Excel to do my personal finances tracking in the first few months, I was paranoid to have my personal details online and potentially hackable.

But over time, I realized that all I really have in there are numbers, and I nicknamed all my accounts so no one but me would understand what it means.

Going from Excel to Google Sheets is amazing because I can now look at my personal finances anytime I want.

I’ve looked at my finances while waiting for my dentist appointment, and sometimes in the car (not driving of course).

That major convenience to quickly be able to look at my personal finance doc anytime anywhere is a big plus.

As I’ve said in past posts, I am a huge believer in “what you focus on, increases”.

In 2012, my finances were blah. So I didn’t care to focus on them.

Over time, I got frustrated with this and started educating myself on how to get out of the situation I was in.

I learned more and more, and applied what I knew. My focus on personal finance helped me 10x the growth of my finances.

I’m smarter now about how money comes into my life, and where I delegate it. I also automate most of it, so it’s just something that happens while I am living my life.

Whether you’re stressed about your money situation or you’re comfortable, you need to chart out your personal finances on Google Sheets.

Why Google Sheets though?

As I said before, using Excel was my first step.

I realized that I could keep my details in the document secure by nicknaming most of it, and Google would be a fairly secure place to keep my file.

I did try using Dropbox to access my Excel file in the early months (back in 2015). The problem with that was that while I can open the file and review what I needed, I couldn’t edit anything from my iPhone.

Downloading Google Sheets for my iPhone was free and secure, so I was happy with it and didn’t question it any more.

It used to be that Google Sheets was pretty behind Excel in shortcuts and features, but over the years they’ve caught up big time and Google’s suite of tools are also 100% free.

One thing I noticed after my transition to Google Sheets, is that I was watching my spreadsheet much more often, even if I was only editing it on the 15th of the month.

In doing so, I started creating more pages in my one sheet file, adding notes for yearly goals, reviewing any costs for my investments (like mutual fund fees), and so on.

The more I was able to review things and keep them in the front of my mind, the more I was able to “optimize” my finances.

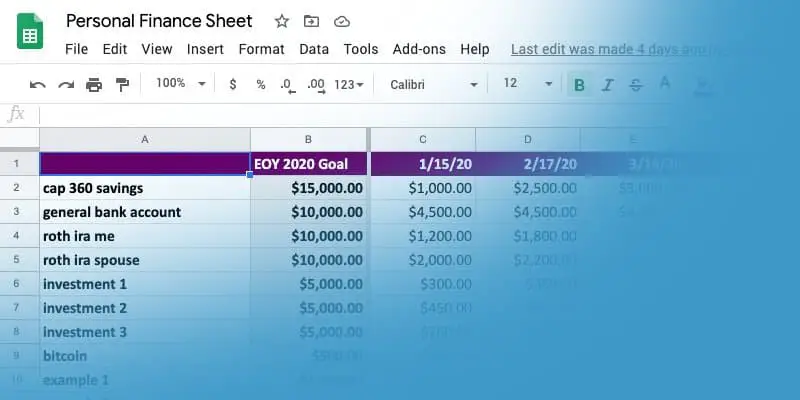

What finances do I keep tabs of in my Google Sheets on a monthly basis?

Over the years, I made new tabs to manage more and more of my personal finances.

To start with, I just created a clean sheet to manage all my savings/investments and my debts.

After a year or two, I made a formula at the bottom of each monthly review that gave me my debt-to-assets ratio.

It’s basically a number I use as a “scorecard” to see how much more savings and investments I have over time, compared to my debts. I try to make it a game and push that number lower and lower over time.

Start using your own personal finance sheet today

Just get started.

Click on this link, it’ll take you to the Google Sheet template, where you can click “make a copy” to have your own duplicate on your private Google account.

Set a timer for 30 minutes, and just start replacing the generic details I setup with your own.

Revisit it once a week in the beginning to just review things, and after that pick a day once a month to re-review all your personal finances.

You’ll love that you can see the changes every single month, and even more so as the years go by.

It takes time to build your finances, especially if you’re starting out, but whenever I go back to my early years and see how much I’ve grown over time, I always get a happy satisfied feeling.

Watch my YouTube video tutorial

If you made a copy of the personal-finance sheet, and need a bit of “over the shoulder” ideas on how to use it, watch my short 10-minute tutorial video below.

Next step, get creative with your finances

Use my template as a starting point, and then build off it.

Your life is different than mine, and different than all your friends. Everyone has different needs and goals.

Here’s a list of examples you might want to include in your savings/investment section and then your debt payoff section

Debt Payoff

- Student loans

- Large medical bills

- Credit card debt

- Home mortgage

- Car payments

- Other personal loans

Get creative, and if you need help or have a question, post your comment below and let’s chat.